US Sawmill Capacity 2024 Plateau: Labor Shortages and Import Impacts

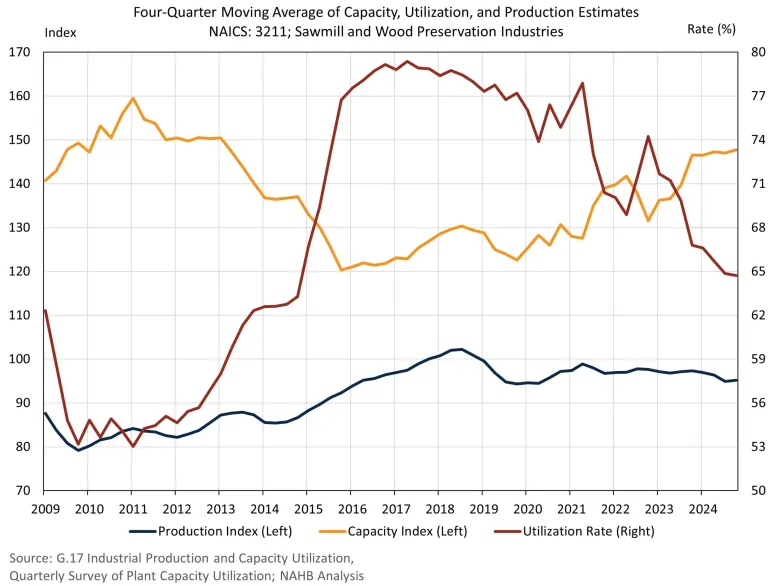

Throughout 2024, sawmill and wood preservation firms reported reduced capacity utilization rates, as well as consistent production and capacity.

Although there was no increase in production in 2024, utilization rates have been decreasing since 2017, as sawmills have increased their production capacity.

Despite the increased production capacity, the actual productivity has not increased, as it remains lower than in 2018.

Firms’ capacity utilization rates are calculated as the ratio of their actual production to their prospective production capabilities.

On a four-quarter moving average basis, the utilization rate for sawmills and wood preservations firms was 64.7% in the fourth quarter.

The gap between complete production capability and actual production has increased as utilization rates have decreased.

The actual production is typically lower than full capability as a result of a variety of factors, including a scarcity of labor and insufficient materials and orders.

The current production capacity of U.S. sawmills and timber preservation firms can be approximated by combining the Federal Reserve‘s production index and the Census Bureau‘s utilization rate to create a rough index estimate.

The production capacity index is estimated quarterly and is presented below.

This capacity index quantifies the actual output that would be produced if all firms were operating at their maximum capacity.

Sawmill production capacity has increased from 2015, as indicated by the aforementioned data, but it continues to be below its record level in 2011. The majority of the most recent capacity gains occurred between 2023 and 2024, with minimal growth occurring throughout 2024.

As demonstrated above, there is a significant amount of potential to increase the production of domestic lumber; however, the present production levels have remained considerably unchanged over the past few years.

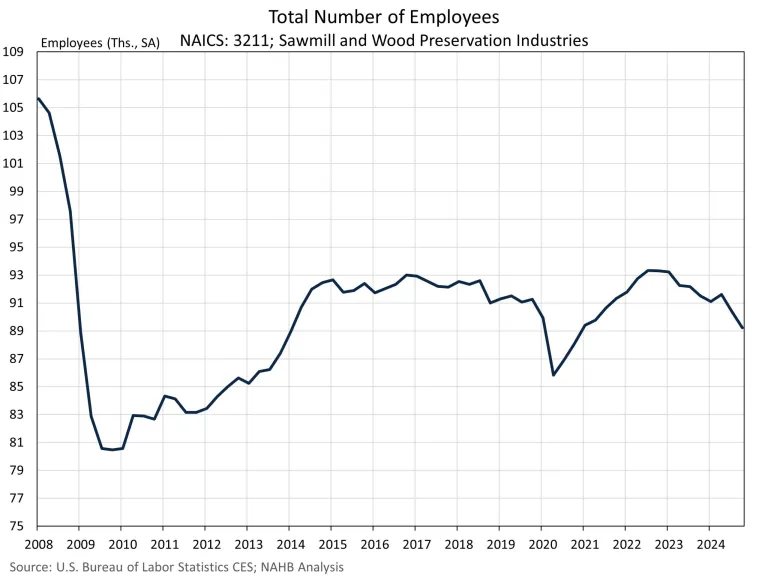

Employment is a critical factor in enabling organizations to operate at their maximum potential. The industry’s average of just over 89,000 employees in the fourth quarter was the lowest since 2021 for sawmill and wood preservation firms.

The decrease in utilization rates can be attributed to employment declines, which are presumably the result of a weak lumber market in 2024.

It is less probable for a company to increase production to its maximum capacity when it has a reduced number of employees.

Imports

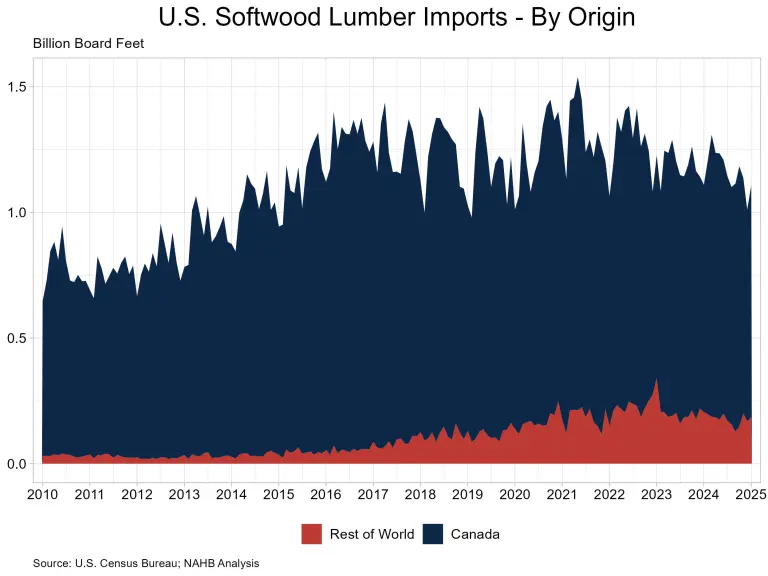

Imports are instrumental in augmenting the domestic supply, particularly in the softwood lumber market, as U.S. firms are unable to operate at their peak capacity.

The current tariffs on Canadian softwood timber have not decreased the necessity for imports to satisfy domestic consumption, as indicated by Census international trade data.

However, they have increased the United States’ dependence on non-North American lumber, leading to unnecessarily intricate supply chains.

The current AD/CVD Canadian softwood lumber tariff rate is 14.5% and is anticipated to double during the administrative review procedure conducted by the Department of Commerce.

The ongoing 232 investigation and a 25% tariff on all Canadian products have the potential to increase the tariff rates on Canadian softwood lumber to over 50% later this year.

Builders who utilize lumber as a critical component of their construction processes will incur increased expenses due to increased tariffs on softwood lumber.

In light of the current housing affordability crisis, any supplementary expenses will exacerbate the difficulty of obtaining affordable housing and homeownership for households in the United States.

[Read more about this story on Eyeonhousing.org]