Tariffs, Costs, and Uncertainty: Builders’ Confidence Plummets

Builder sentiment declined in March, despite builders’ optimism that a more favorable regulatory environment will result in an improved business climate, as a result of economic uncertainty, the potential for tariffs, and increased construction costs.

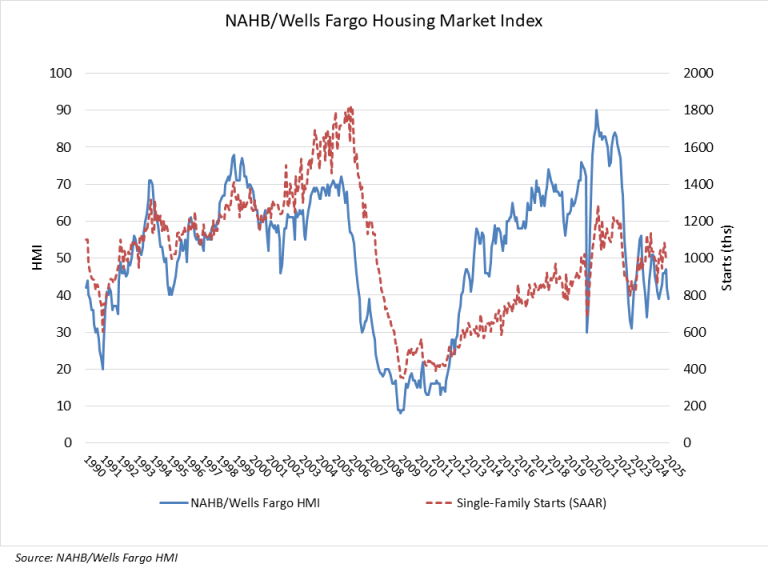

According to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI), the builders’ confidence in the market for newly constructed single-family homes decreased to 39 in March, the lowest level in seven months and a three-point decrease from February.

Builders are still confronted with exorbitant construction material costs, which are further exacerbated by tariff issues, as well as other supply-side challenges such as labor and lot shortages.

Simultaneously, builders are beginning to observe regulatory relief in order to mitigate the increasing cost curve.

This is evidenced by the Trump administration’s decision to suspend the 2021 IECC building code requirement and to implement the regulatory definition of “waters of the United States” under the Clean Water Act in accordance with the U.S. Supreme Court’s Sackett decision.

Tariffs are causing additional cost pressures for construction firms.

The HMI March survey data indicates that builders anticipate a typical cost effect of $9,200 per home as a result of recent tariff actions.

Home buyers and development decisions are also being adversely affected by policy uncertainty.

In March, 29% of builders reduced home prices, which represents an increase from 26% in February, according to the most recent HMI survey.

In March, the average price reduction was 5%, which was consistent with the previous month.

In March, sales incentives were implemented at a rate of 59%, which was consistent with February.

The NAHB/Wells Fargo HMI, which is based on a monthly survey that NAHB has been conducting for over 35 years, assesses builder perceptions of present single-family home sales and sales expectations for the next six months as “good,” “fair,” or “poor.”

The survey also requests that builders evaluate the traffic of potential purchasers as “high to very high,” “average,” or “low to very low.”

The scores for each component are subsequently utilized to generate a seasonally adjusted index.

A value greater than 50 indicates that a greater number of builders perceive the conditions as favorable than unfavorable.

In March, the HMI index, which measures present sales conditions, decreased by three points to 43, the lowest level since December 2023.

The component measuring sales expectations in the next six months remained at 47, while the gauge charting traffic of prospective purchasers decreased by five points to 24.

The regional HMI scores experienced a three-point decline in March, with the Northeast falling three points to 54, the Midwest moving three points lower to 42, the South dropping four points to 42, and the West posting a two-point decline to 37.

This information was derived from the three-month moving averages. The HMI tables are available at nahb.org/hmi.

[Read more about this story on Eyeonhousing.org]