Single-Family Slips, Multifamily Surges in June

Increased interest rates on home mortgages and construction and development loans slowed single-family production and demand in June.

Housing starts jumped 3.0% in June to a seasonally adjusted annual pace of 1.35 million units, according to a study released by the United States Department of Housing and Urban Development and the United States Census Bureau.

The June value of 1.35 million starts represents the number of housing units that would be built if construction continued at this rate for the next year.

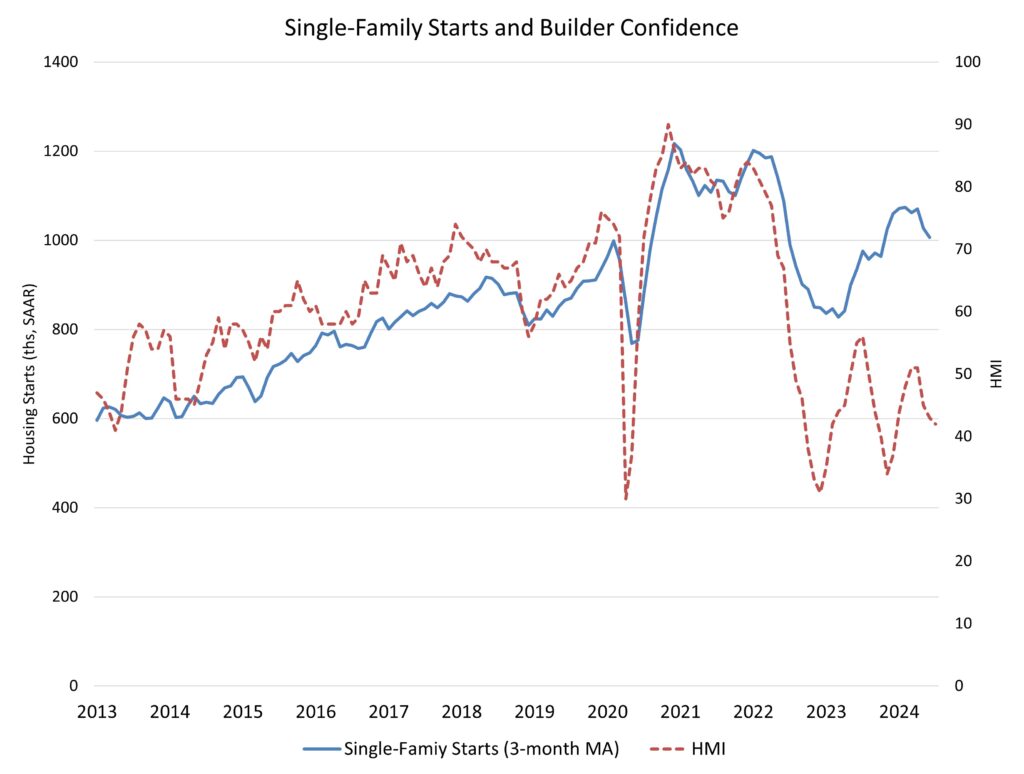

Within this overall statistic, single-family starts fell 2.2% from an upwardly revised May figure, to 980,000 seasonally adjusted annual rates.

However, year-to-date, single-family starts are up 16.1% in 2024.

Lower single-family starts are consistent with our most recent industry surveys, which indicate that builders are apprehensive about the present high interest rate environment.

With improved inflation numbers, the Federal Reserve is projected to begin rate cuts later this year.

An better interest rate environment will benefit purchasers, builders, and developers who are dealing with tight credit conditions and high interest rates.

And, with total (new and existing) home inventory at a comparatively low 4.4 months’ supply, builders are planning to increase production in the coming months.

Indeed, NAHB survey data on builder sales estimates showed an increase in July.

The volatile multifamily sector, which includes apartment complexes and condos, grew by 19.6% in June to an annualized 373,000 units.

However, the overall trend in apartment construction is lower. The number of multifamily 5-plus unit starts is down 23.4% from a year earlier.

Year to date, multifamily 5-plus unit starts are down 36.3%.

On a regional and year-to-date basis, combined single- and multifamily starts are 9.9% lower in the Northeast, 3.4% lower in the Midwest, 3.5% lower in the South, and 0.7% higher in the West.

In June, overall permits jumped 3.4% to 1.45 million units on an annualized basis.

The number of single-family permits declined by 2.3% to 934,000 units. Multifamily permits increased 15.6% to an annualized 512,000 pace.

Looking at regional data year to date, permits are 0.8% lower in the Northeast, 3.0% higher in the Midwest, 0.7% lower in the South, and 3.8% lower in the West.

As of June, there were 1.56 million single-family homes and apartments under construction. This marks the lowest total since January 2022.

The number of single-family homes under construction declined 1.3% to 668,000, down 2.2% from the previous year. The number of multifamily apartments under construction fell 1.6% to 895,000, down 11.4% from the previous year.

The number of multifamily units under development is at its lowest since August 2022. This count will continue to decrease.

On a three-month moving average, there are now 1.7 completed flats for every one that is under construction.

Multifamily completions reached a seasonally adjusted annual rate of 673,000 in June. This is the fastest pace of apartment completions since May 1986.

This new supply will provide some relief for shelter inflation and give the Fed confidence to start decreasing interest rates this year.

[Read more about this topic on Eyeonhousing.org]