Sawmill Production Drops During the First Quarter

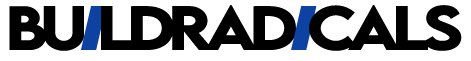

The sawmill and wood preservation sectors’ production index declined to 91.9 in the first quarter of 2024 (the indicator measured real output in 2017 at 100).

According to the Federal Reserve’s most recent G.17 statistics release, this is the second consecutive quarterly fall.

The index declined 4.3% in the first quarter of 2024, following a 4.3% drop in the preceding quarter. In comparison to the previous year, production was 3.8% lower at the start of 2024.

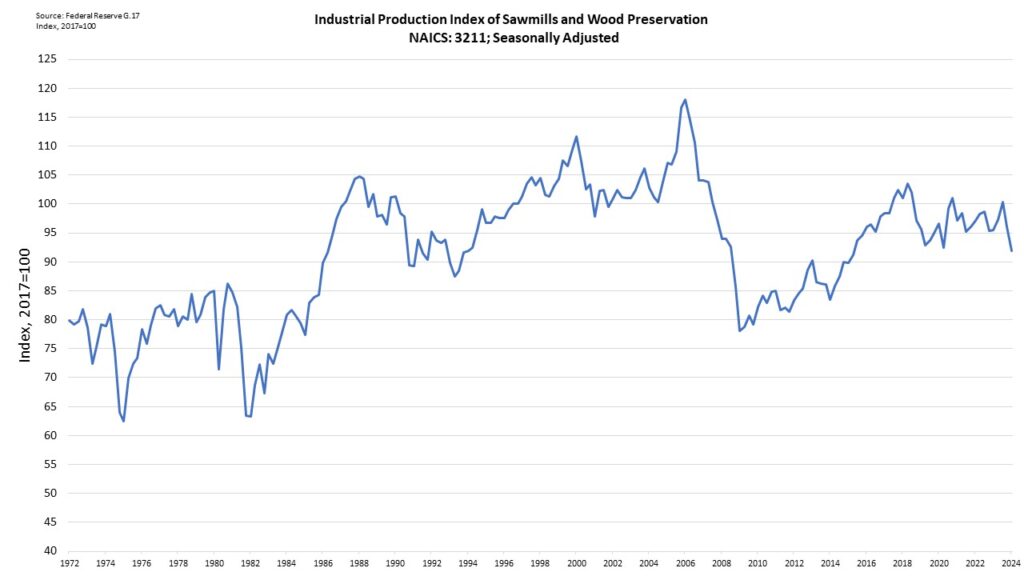

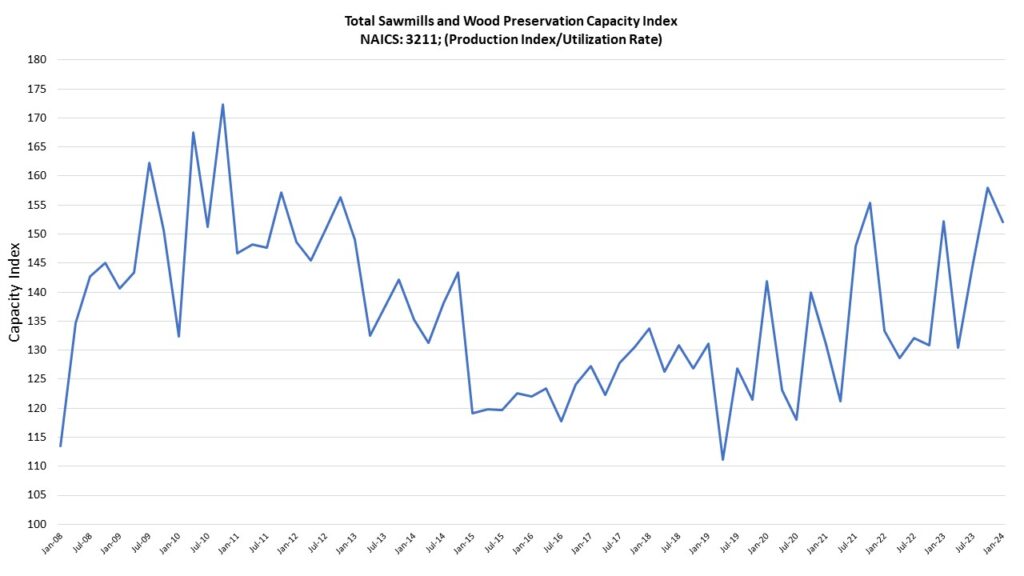

The Census Bureau’s Quarterly Survey of Plant Capacity Utilization is another useful resource for learning more about the sawmill and wood preservation businesses.

This data is based on quarterly surveys of domestic manufacturing plants in the United States, and it includes a subindustry grouping of sawmills and wood preservation enterprises.

These utilization rate estimates are based on full production capability, which means that they are calculated by taking the market value of actual production during the quarter and dividing it by an estimated market value of what the firm could have produced at full capacity.

For the second quarter in a row, the sawmill and wood preservation industries’ full utilization rates declined slightly, from 60.8% to 60.4%.

This drop helps to explain why the industry’s production is declining.

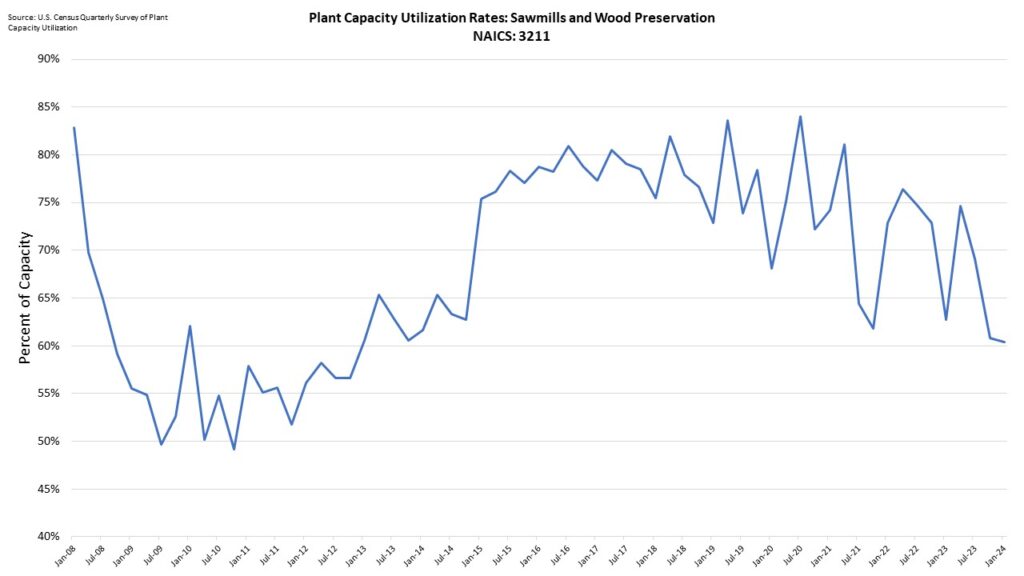

Furthermore, when these enterprises’ average plant hours per week in operation declined, the drop was not attributed to an increase in production capacity, but rather to a decrease in output as the facilities were in operation for less hours.

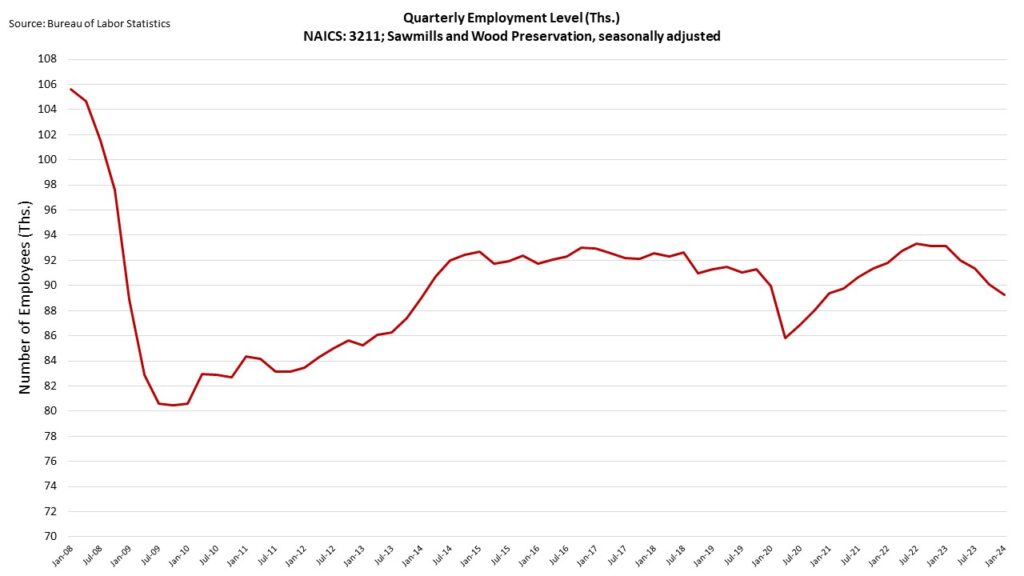

Notably, employment at these organizations has declined during the first quarter of 2023.

Employment reached 93,130 in 2023, but declined to 89,260 in the first quarter of 2024. Employment in sawmills dropped in each quarter of 2023.

The Great Recession had a significant impact on this industry, with employment dropping from 105,630 in the first quarter of 2008 to a series low of 80,470 in the fourth quarter of 2009.

Employment increased from this low in 2009 to 91,000 in 2014, and it has maintained around this level for the past ten years.

By combining the production index and utilization rates, we can get a reasonable estimate of the current output capacity of US sawmills and wood preservation enterprises.

The production capacity index is estimated quarterly, as shown below.

This capacity index represents the real production if all enterprises were operating at full capacity.

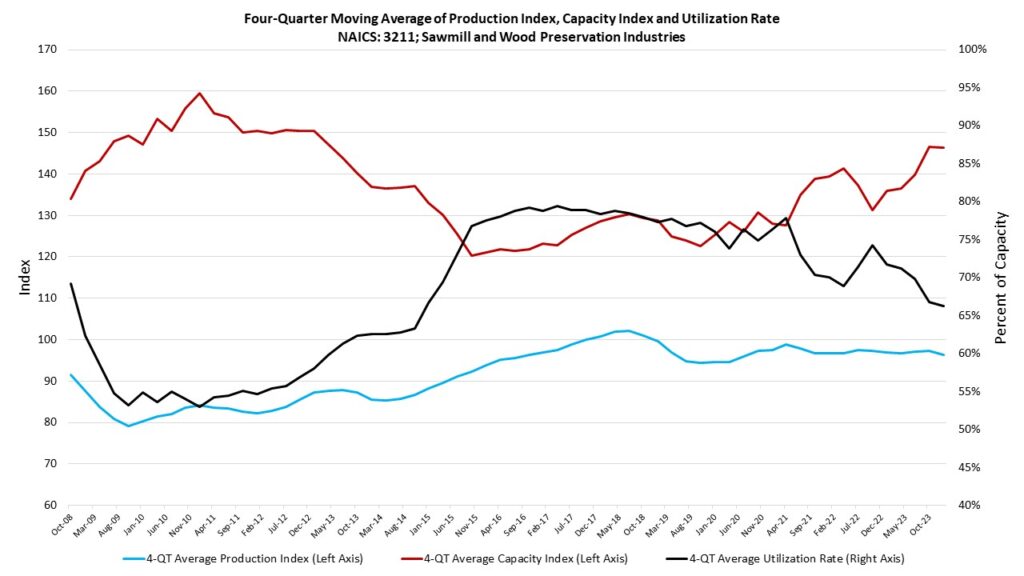

Because the data is dynamic, a moving average of utilization rates, the production index, and the capacity index are presented below to provide a more complete picture of the industry.

According to the data above, sawmill output capacity has increased since 2015 but remains lower than peak levels in 2010.

Sawmill production continues to rise, owing to stronger utilization levels than in the past, as illustrated in black above.

Much of the capacity expansion has occurred recently, as utilization rates have declined while production has remained strong.

[Read more about this topic on Eyeonhousing.org]