Residential Construction Loan Declines

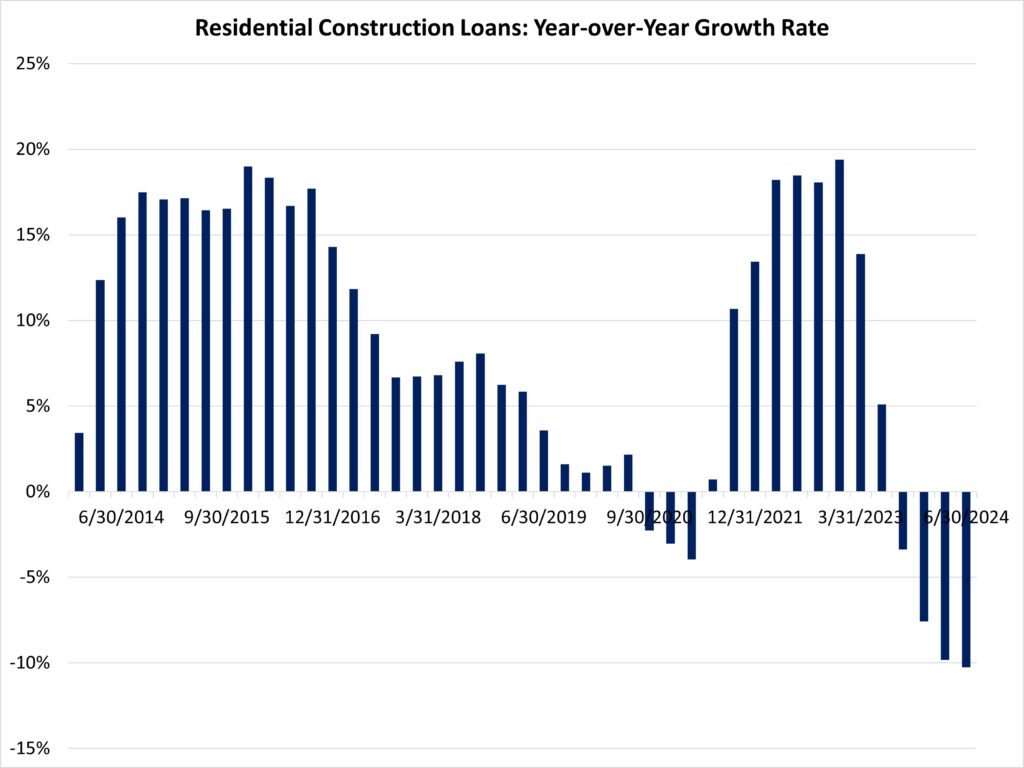

The volume of total outstanding acquisition, development, and construction (AD&C) loans experienced the most significant year-over-year percentage decline since 2012 during the second quarter of 2024.

This decline was primarily due to the fact that interest rates remained elevated prior to the Federal Reserve’s decision to reduce short-term interest rates in September.

The conditions of AD&C loans will improve as the Federal Reserve advances in its policy easing cycle.

During the second quarter, the volume of residential construction loans for 1-4 units that were made by FDIC-insured institutions decreased by 3.5%.

For the quarter, the outstanding stock of loans decreased by $3.3 billion.

The total stock of home building construction loans has decreased to $92 billion as a result of this loan volume retreat, which is below the post-Great Recession high of $105 billion that was achieved in the first quarter of 2023.

Private builder home construction is being impeded by the decrease in loan volume, which is also affecting the sentiment of home builders.

The stock of residential construction loans has experienced a more than 10% decline in the past year, the most significant year-over-year decline since 2012.

This contraction in construction financing is a significant factor contributing to the decline in home builder sentiment at the end of 2023, despite the fact that building activity accelerated due to increased builder activity.

It is important to acknowledge that the FDIC data only represent the stock of loans, not changes in the fundamental flows. Consequently, it is an imperfect data source.

Lending has experienced a substantial decline in recent years.

The current quantity of existing residential AD&C loans is 55% lower than the peak level of residential construction lending of $204 billion that was reached during the first quarter of 2008.

In recent years, this capital market has been supplemented by alternative sources of financing, such as equity partners.

The FDIC data indicate that the cumulative decline from peak lending for home building construction loans continues to surpass that of other AD&C loans (nonresidential, land development, and multifamily).

These types of AD&C lending are 7% lower than peak lending.

The outstanding stock of these loans remained relatively constant during the second quarter.

[Read more about this topic on Eyeonhousing.org]