Residential Construction Input Prices Rise in January

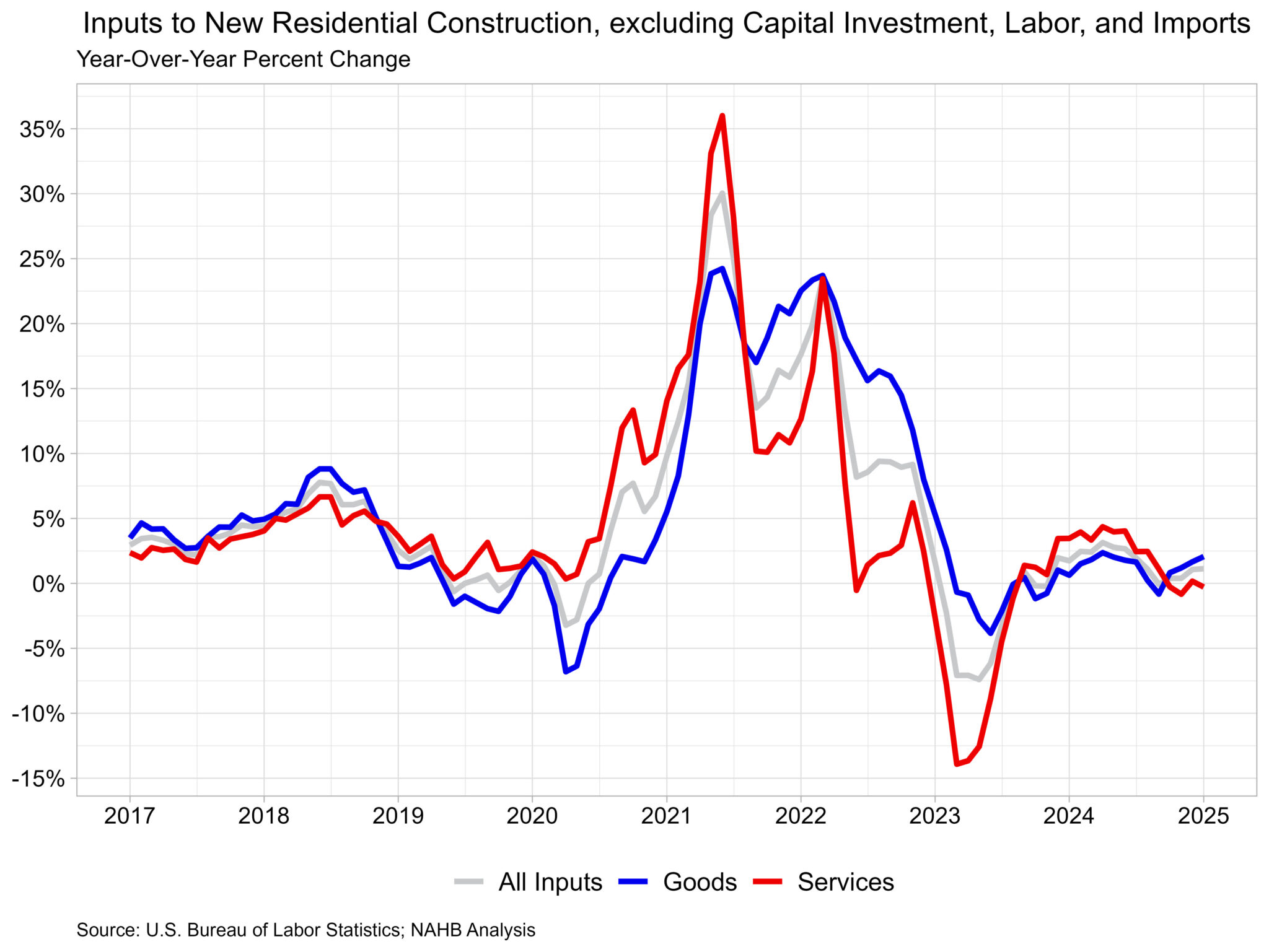

According to the most current Producer Price Index (PPI) report published by the United States Bureau of Labor Statistics, prices for inputs to new residential construction, excluding capital investment, labor, and imports, increased 1.2% in January.

The Producer Price Index measures the prices received by domestic producers for their goods and services, as opposed to the Consumer Price Index, which measures what consumers pay for both domestic and imported items.

The inputs to the New Residential Construction Price Index increased by 1.1% from January of last year.

The index is divided into two components: products increased 2.1% during the year, while services fell 0.3%.

For comparison, the overall final demand index, which measures all products and services in the economy, rose 3.5% over the year, with final demand for commodities rising 2.3% and final demand for services rising 4.1%.

Input goods

The goods component represents approximately 60% of the total residential building inputs price index.

The price of input commodities for new home building increased 1.6% in January. The index’s monthly growth has been rather low during the last two years, and this month’s gain was the greatest since March 2022 (3.3%).

The input goods to residential building index can be further divided into two independent components, one measuring energy inputs and the other measuring goods minus energy inputs.

The latter of the two components essentially indicates building materials used in residential construction, which accounts for around 93% of the goods index.

The 2.1% annual gain in the products component can be attributable to rising building material prices, which increased by 2.3% over the year. Meanwhile, energy input prices fell 1.6% from previous year.

Between December and January, building materials rose 1.4%, while energy inputs rose 4.3%.

At the individual commodity level, the five most important building materials for the New Residential Construction Index were ready-mix concrete, general millwork, paving mixtures/blocks, sheet metal products, and wood office furniture/store fixtures.

Ready-mix concrete increased by 4.1% over the previous year, as did wood office furniture/store fixtures, general millwork, paving mixtures/blocks, and sheet metal items.

In January, the commodity utilized in new residential building with the largest price growth was energy input, home heating oil and distillates, which increased by 16.0%. Paving mixtures and blocks experienced the largest monthly price growth of any non-energy item, rising 14.8%.

This is most likely a reflection of rises in asphalt pricing, which rose 6.9% in January.

Input Services

While input prices for residential building services fell 0.3% year on year, they rose 0.5% in January compared to December.

The price index for service inputs to residential construction is divided into three categories: trade services, transportation and warehousing services, and services excluding trade, transportation, and warehousing.

The most major component is trade services (about 60%), followed by services other than trade, transportation, and warehousing (approximately 29%), and finally transportation and warehousing services (around 11%). The largest component, trade services, fell 1.9% from a year earlier.

The services component, excluding commerce, transportation, and warehousing, increased 1.6% year on year.

Finally, transportation and warehousing service prices rose 3.1% from January last year, the biggest year-over-year increase since January 2023.

[Read more about this topic on Eyeonhousing.org]