Private Residential Construction Spending Falls in January

In January, private residential construction spending fell by 0.4%, owing primarily to a reduction in multifamily construction and home renovation investment.

This dip came after three months of uninterrupted gain, demonstrating a negative trend in the monthly data.

Despite the monthly decline, spending is 3.1% higher than a year ago, demonstrating the housing market’s resiliency.

According to the most recent US Census Construction Spending data, multifamily construction spending declined by 0.7% for the month, continuing the decreasing trend that began in December 2023.

This reduction is consistent with a weak Multifamily Production Index (MPI) and fewer multifamily homes under development.

Improvement spending fell by 1.5% in January, but it was 14.3% greater than the same period last year.

Meanwhile, investment on single-family building increased by 0.6% in January, resuming growth after a five-month decrease from April to August.

This increase is also consistent with the Housing Market Index, which shows continuing builder optimism.

However, single-family development remained 0.9% lower than a year earlier.

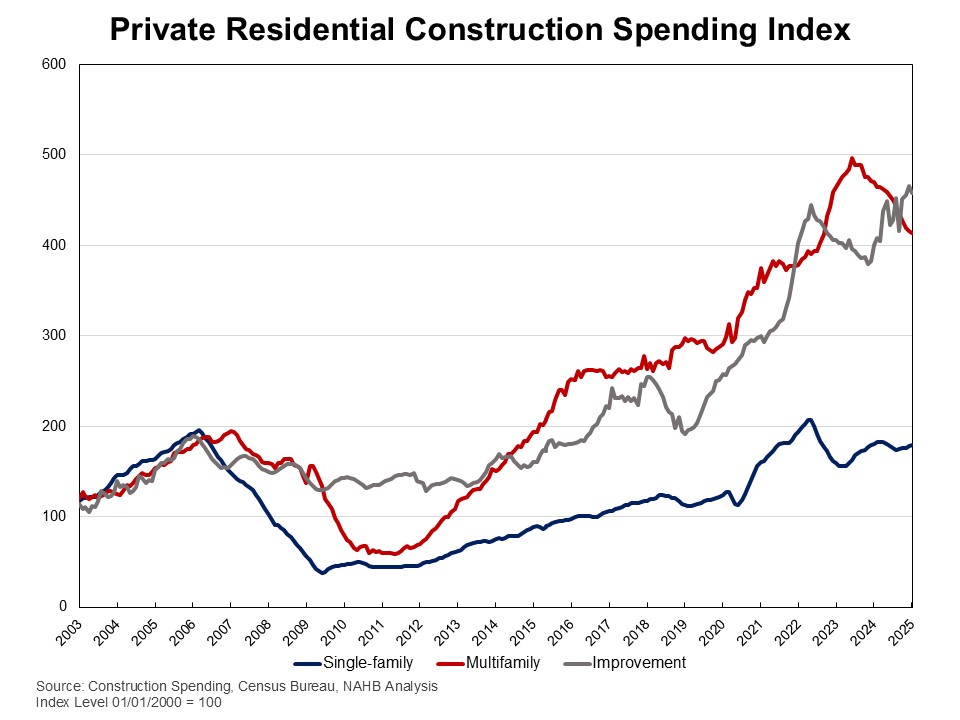

The graph below shows the NAHB construction spending index.

The indicator shows how spending on single-family construction has declined since early 2024 as a result of rising interest rates and concerns about building material tariffs.

Multifamily construction spending growth has likewise declined from its peak in July 2023. Meanwhile, upgrade investment has accelerated since late 2023.

Spending on private nonresidential construction increased by 1.8% from a year ago. The annual rise in private nonresidential spending was mostly attributable to increasing spending in the manufacturing category ($12.4 billion), followed by power ($5.5 billion).

[Read more about this story on Eyeonhousing.org]