NAR: October Existing Home Sales Rebound

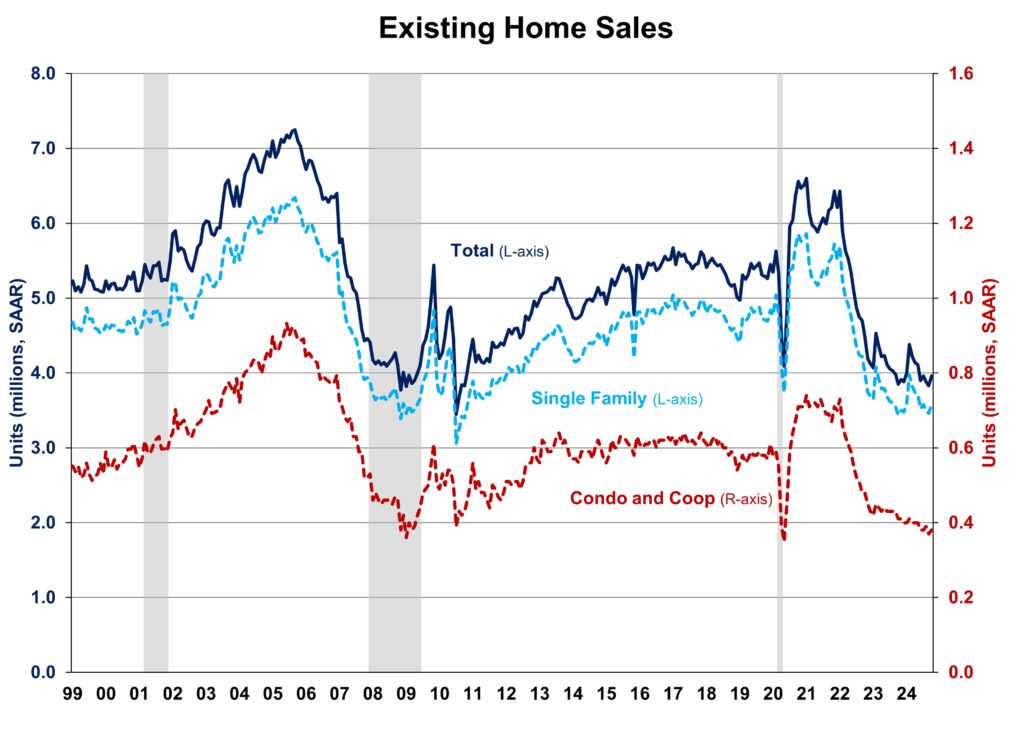

Existing home sales returned from a 14-year low in October, posting the first yearly increase in more than three years, as buyers took advantage of mortgage rates momentarily falling to a 2-year low in late September, according to the National Association of Realtors.

While inflated home prices remain due to the lock-in effect, we anticipate increased sales activity as mortgage rates drop with fresh Fed easing. Improving inventory could moderate home price rise and increase affordability.

Homeowners with lower mortgage rates have chosen to stay put, rather than switching from their current mortgages to new ones with higher rates.

This pattern is raising housing prices while holding back inventories.

Mortgage rates are likely to steadily fall as the Federal Reserve begins its easing cycle at the September meeting, resulting in higher demand and unlocking lock-in inventories in the following quarters.

In October, total existing home sales (including single-family homes, townhomes, condominiums, and co-ops) increased 3.4% to a seasonally adjusted annual pace of 3.96 million.

Sales were 2.9% higher year on year, bringing an end to a 38-month streak of year-over-year losses that began in July 2021.

The first-time buyer proportion increased to 27% in October, up from 26% in September but falling from 28% in October 2023.

The existing house inventory increased from 1.36 million in September to 1.37 million units in October, up 19.1% over the previous year.

At the current sales rate, October unsold inventory is 4.2 months, down from 4.3 months last month but up 3.6 months year on year.

This inventory level remains low when compared to balanced market conditions (4.5 to 6 months’ supply), demonstrating the long-term need for greater housing development.

Homes remained on the market for an average of 29 days in October, up from 28 in September and 23 in October 2023.

In October, all-cash sales accounted for 27% of all transactions, down from 30% in September and 29% the previous year. Interest rate adjustments have less of an impact on all-cash buyers.

The October median sales price for all existing homes was $407,200, up 4.0% from the previous year. This was the 16th straight month of year-over-year growth.

In October, the median condominium/co-op price was $360,300, up 1.6% over the previous year.

This rate of price growth will slow as inventory levels rise.

In October, existing house sales increased in all four areas, with the West up 1.3% and the Midwest up 6.7%. Sales in the Midwest, South, and West increased by 1.1%, 2.3%, and 8.5%, respectively, year on year.

Sales in the Northeast remained unchanged.

The Pending Home Sales Index (PHSI) is a forward-looking indicator that relies on signed contracts. The PHSI increased from 70.6 to 75.8 in September, owing to higher inventories and reduced mortgage rates in late summer.

Pending sales up 2.6% year on year, according to National Association of Realtors data.

[Read more about this topic on Eyeonhousing.org]