NAHB: Builder Credit Tightens, Mixed Cost Results

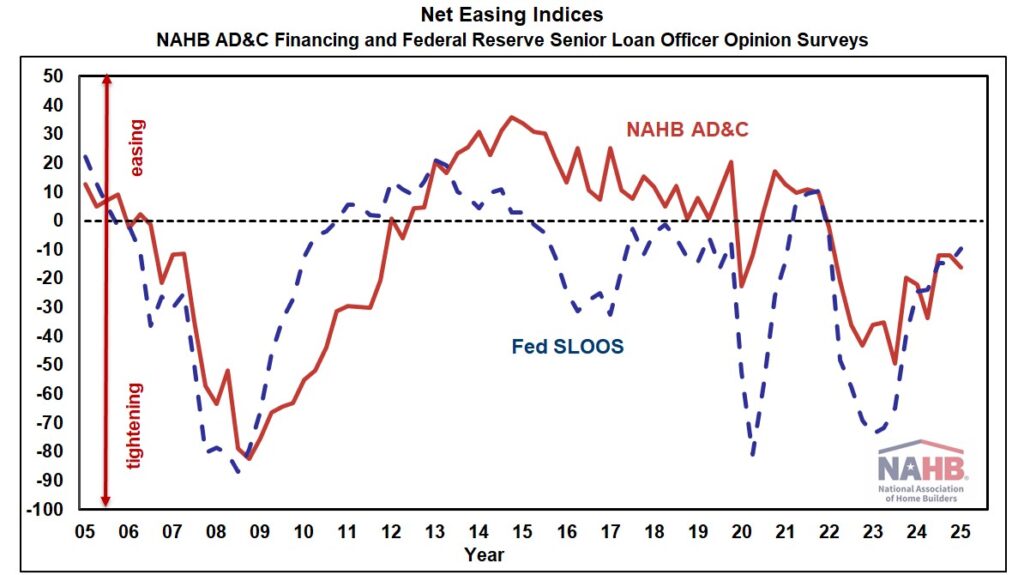

Borrowers and lenders agreed that credit for residential Land Acquisition, Development, and Construction (AD&C) tightened further in the fourth quarter of 2024, according to the NAHB’s AD&C Financing survey and the Federal Reserve’s senior loan officer survey.

The NAHB net easing index was -16.3, while the Fed’s equivalent indicator was -9.5.

Although the extra net tightening in the fourth quarter was small (as evidenced by negative figures far closer to 0 than -100), it is the eleventh consecutive quarter in which both surveys recorded net tightening of credit for AD&C.

According to the NAHB poll, the most prevalent ways for lenders to tighten in the fourth quarter were to lower the loan-to-value or loan-to-cost ratio (72% of builders and developers indicated this) and to reduce the amount they are ready to lend (61%).

An prior piece covered more data from the Fed’s lender survey, such as demand and net easing for residential mortgages.

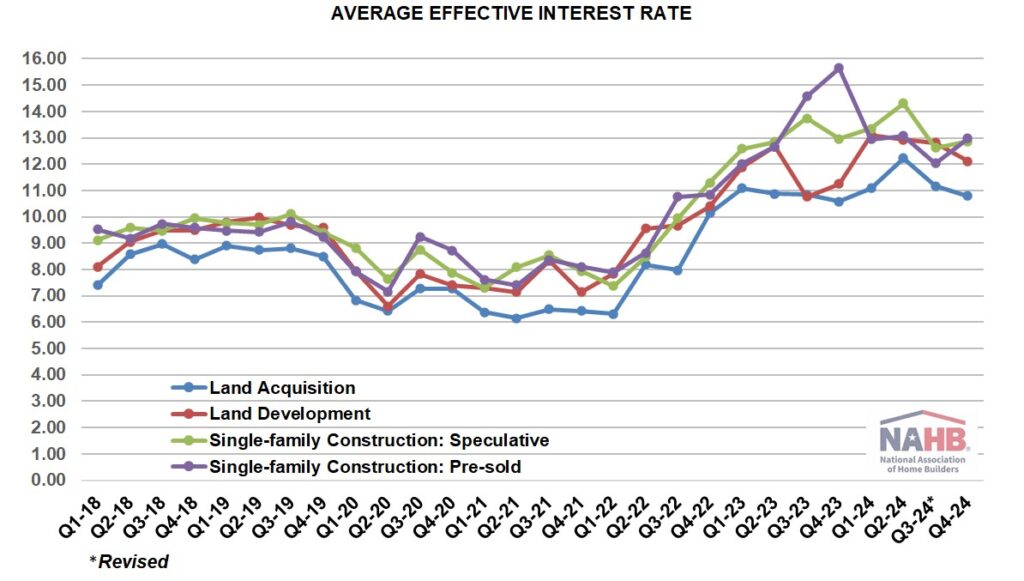

For the second quarter in a row, the contract interest rate fell across all four loan categories covered by the NAHB AD&C survey.

In the fourth quarter of 2024, the average contract interest rate fell from 8.50% in 2024 Q3 to 8.48% on loans for land acquisition, 8.83% to 8.28% on loans for land development, 8.54% to 8.34% on loans for speculative single-family construction, and 8.11% to 7.75% on loans for pre-sold single-family construction.

In addition to the contract rate, initial loan points can be a significant component of the ultimate cost of credit, particularly for loans paid off as rapidly as conventional single-family construction loans. The fourth quarter had uneven developments in terms of beginning points.

Average points on land acquisition loans fell from 0.77% in the third quarter of 2024 to 0.55%.

Loans for land development (0.68% to 0.75%), pre-sold single-family construction (0.26% to 0.67%), and speculative single-family construction (0.49% to 0.64%) all saw a rise in average points quarter over quarter.

Not unexpectedly, the above-mentioned opposing patterns produced inconsistent results for the overall cost of AD&C borrowing, as measured by the average effective interest rate.

In the fourth quarter of 2024, the average effective rate on land acquisition loans fell from 11.17% in the third quarter of 2024 to 10.79%, and on land development loans from 12.82% to 12.12%.

Meanwhile, the average effective rate on loans for speculative single-family construction rose from 12.61% to 12.86%, while loans for pre-sold single-family building rose from 12.03% to 12.98%.

Despite the disparate fluctuations between 2024 Q3 and 2024 Q4, the average effective interest rates on all four categories of AD&C loans were at least marginally lower in 2024 Q4 than in 2024 Q2.

More information on credit conditions for residential builders and developers can be found on NAHB’s AD&C Financing Survey website

[Read more about this topic on Eyeonhousing.org]