May Sees Housing Starts Retreat Amidst High Borrowing Costs

Single-family and multifamily housing starts declined in May, as high interest rates on construction and development loans, as well as rising mortgage rates, slowed housing supply and demand.

According to a report from the US Department of home and Urban Development and the Census Bureau, overall home starts declined 5.5% in May to a seasonally adjusted annual pace of 1.28 million units.

The May reading of 1.28 million starts represents the amount of housing units built if construction continued at this rate for the next 12 months.

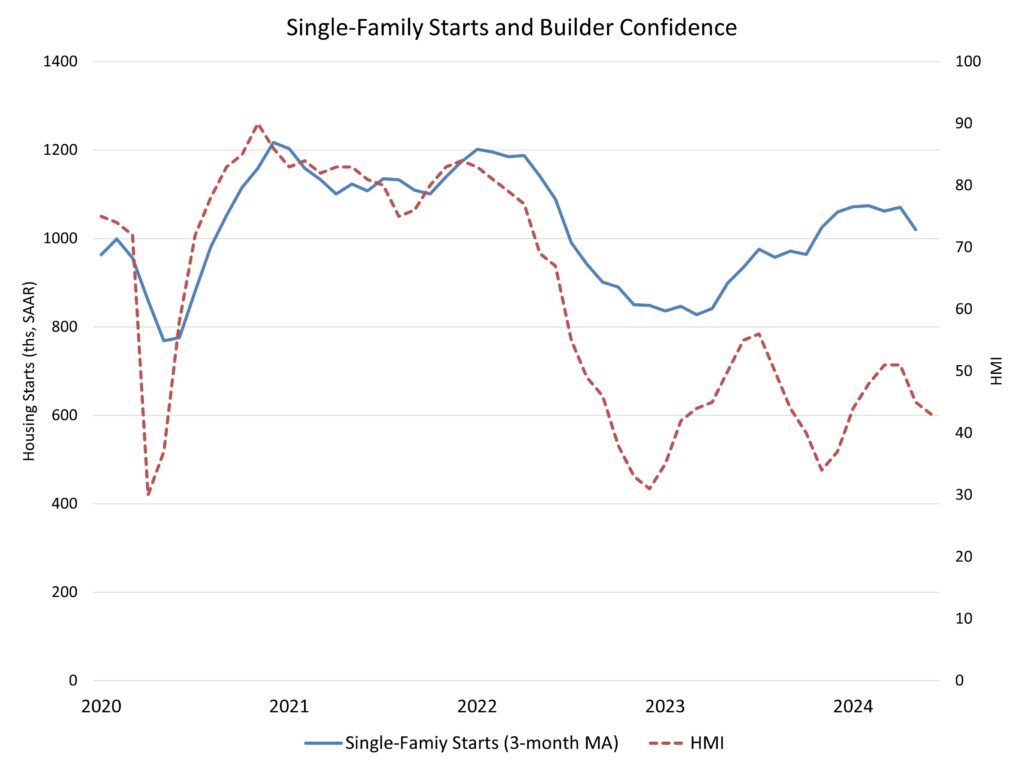

Within this total, single-family starts fell 5.2% to 982,000 seasonally adjusted annual rate.

Single-family starts are up 18.8% year to year, despite the dismal early 2023 numbers.

Mortgage rates averaged 7.06% in May, according to Freddie Mac, the highest since November 2023. Many potential purchasers are still on the sidelines due to the current high interest rate environment.

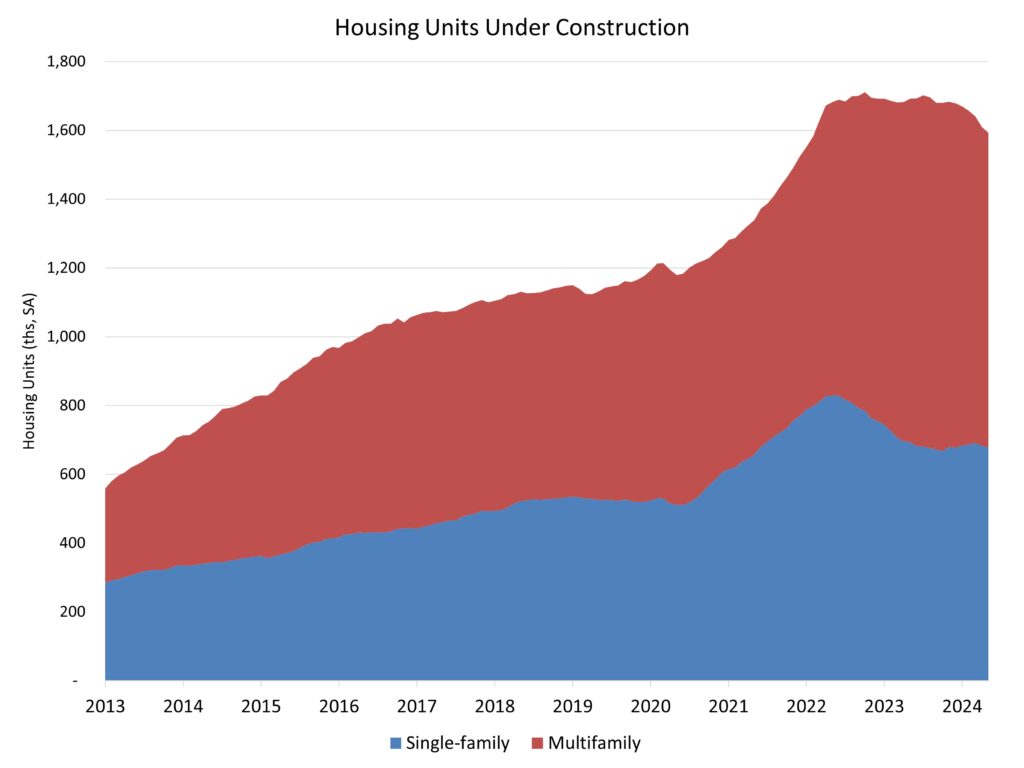

The multifamily sector, which includes apartment complexes and condos, fell 6.6% to an annualized 295,000. This is the lowest apartment development rate since April 2020.

The three-month moving average for multifamily starts has dropped to its lowest level since the fall of 2013, as multifamily development slows.

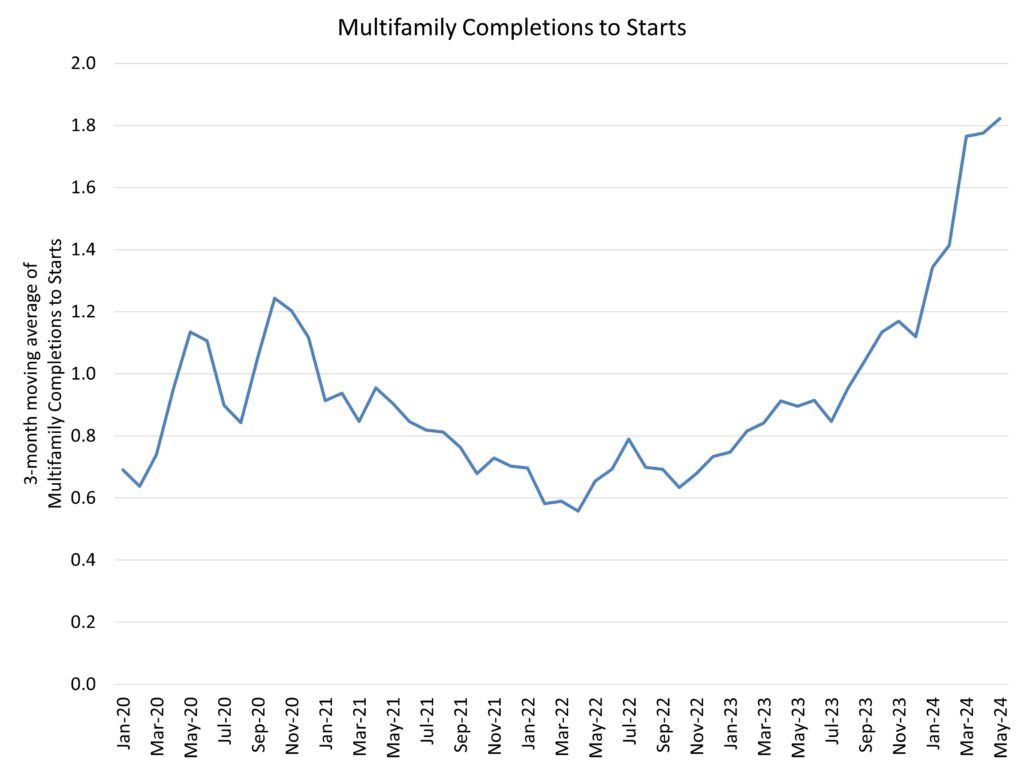

In May, the ratio of multifamily completions to starts (the total number of apartments completed relative to those under construction) was 1.8, nearly tying April for the highest ratio since COVID-19.

This ratio was 0.6 in April 2022, when far more apartments were under construction than finished, indicating a substantial reversal in the multifamily development pipeline.

The number of units under construction has fallen to 914,000, the lowest since September 2022 and 11% lower than the peak pace in July 2023. There are 679,000 single-family homes under construction, an 18% decrease from late Spring 2022.

Regionally and year-to-date, total single-family and multifamily starts are 22.2% lower in the Northeast, 8.0% lower in the Midwest, 2.3% lower in the South, and 2.6% higher in the West.

Multifamily development declines are driving the deterioration in regions with declining year-to-date total housing starts.

In May, overall permits fell 3.8% to 1.39 million units on an annualized basis. Single-family permits fell 2.9% to 949,000 units, the lowest rate since June 2023.

Multifamily permits fell 5.6% to a yearly rate of 437,000.

Looking at year-to-date regional data, permits are 0.7% higher in the Northeast, 5.3% higher in the Midwest, 0.8% higher in the South, and 1.5% lower in the West.

[Read more about this topic on Eyeonhousing.org]