High Mortgage Rates Cool Builder Confidence

Mortgage rates remain in the 7% level, and rising construction financing costs continue to dampen builder optimism.

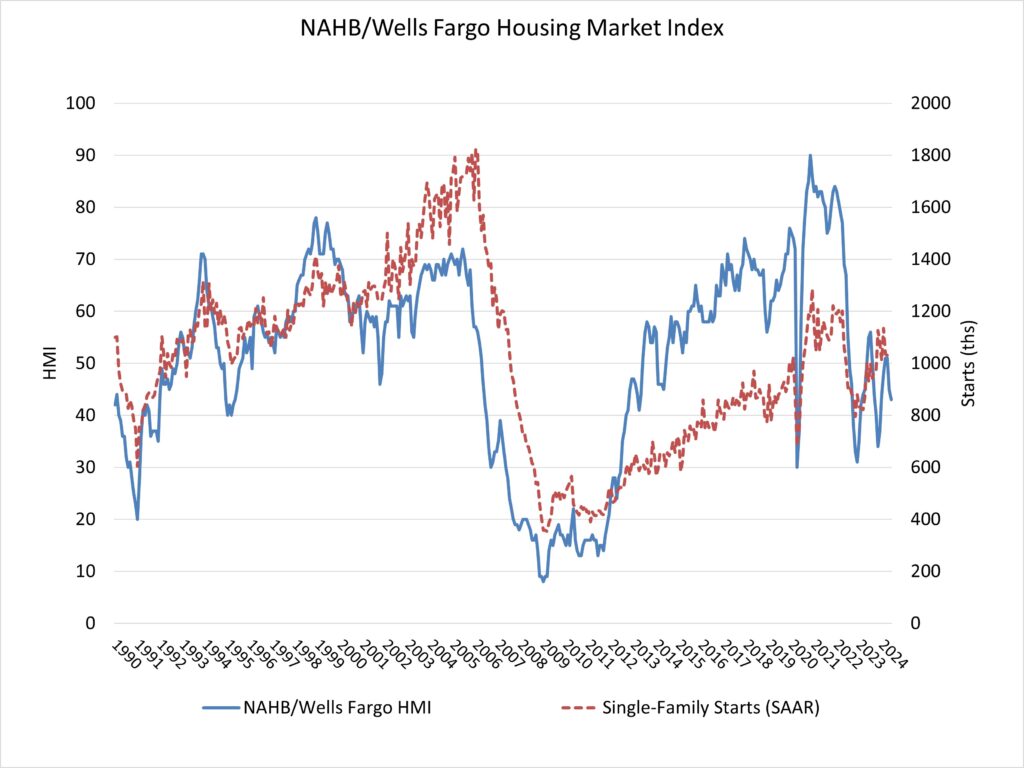

Builder confidence in the market for newly built single-family homes fell two points from May to 43 in June, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI), which was issued today.

This marks the lowest reading since December 2023.

Many prospective purchasers are putting off their purchases due to persistently high mortgage rates.

The economy, and more specifically monetary policy, is in an unusual situation because a lack of progress in cutting shelter inflation, which is currently running at 5.4% year on year, is making it difficult for the Federal Reserve to meet its target inflation rate of 2%.

The best method to reduce shelter inflation and bring the total inflation rate down to the 2% level is to grow the nation’s housing stock. A more advantageous interest rate environment for construction and development loans would aid in this goal.

According to the June HMI survey, 29% of builders reduced home prices to boost sales in June, the biggest share since January 2024 (31%), and significantly higher than the 25% rate in May.

However, the average price drop in June remained at 6% for the 12th consecutive month.

Meanwhile, the utilization of sales incentives rose to 61% in June from 59% in May.

This measure has reached its greatest share since January 2024 (62%).

The NAHB/Wells Fargo HMI is based on a monthly poll conducted by NAHB for over 35 years.

It assesses builder perceptions of current single-family home sales and sales projections for the next six months as “good,” “fair,” or “poor.”

The study also asks builders to rank traffic from prospective purchasers as “high to very high,” “average,” or “low to very low.”

Scores for each component are then used to produce a seasonally adjusted index, with any figure more than 50 indicating that more builders regard conditions as favorable rather than poor.

All three HMI component indicators fell in June, and all are below the crucial level of 50 for the first time since December 2023.

The HMI index charting present sales circumstances in June slid three points to 48; the component charting sales expectations in the next six months down four points to 47; and the gauge calculating prospective buyer traffic fell two points to 28.

Looking at the three-month moving averages for regional HMI scores, the Northeast remained stable at 62, the Midwest dropped three points to 47, the South fell three points to 46, and the West fell two points to 41.

[Read more about this topic on Eyeonhousing.org]