Fourth Quarter 2024 State and Metro Area House Price Appreciation

After two consecutive quarters of slowing, house price appreciation rebounded marginally in the fourth quarter of 2024, owing to persistently high mortgage rates and little inventory.

Although existing house inventories have increased from a year ago, the current 3.5-month supply remains below the 4.5- to 6-month supply required for a balanced housing market.

According to the Federal Housing Finance Agency’s (FHFA) quarterly all-transactions House Price Index (HPI), house prices in the United States increased by 5.4% in the fourth quarter of 2024 compared to the same quarter in 2023.

The year-over-year rate has fallen from a high of 20.6% in the second quarter of 2022, although it remains greater than the previous quarter’s rate of 5.2%.

The quarterly FHFA HPI not only reports national house prices, but it also gives information on state and metro area price changes.

The FHFA HPI used in this article is the all-transactions index, which measures average price changes in repeat sales or refinancings of single-family homes.

From the fourth quarter of 2023 to the fourth quarter of 2024, 49 states and the District of Columbia experienced positive house price growth.

Vermont led the way in terms of house price appreciation, rising 8.9%, followed by New Jersey and Connecticut, both up 8.3%.

On the other hand, Louisiana had the lowest house price appreciation (+2.1%), while Hawaii was the only state to see a price decrease (-4.3%).

Among the 50 states and the District of Columbia, 31 met or exceeded the national growth rate of 5.4%. In the fourth quarter, 32 of the 50 states’ housing prices increased faster than in the third quarter of 2024.

Year-on-year, house price growth varied greatly across US metro regions, ranging from -4.9% to +24.7%.

In the fourth quarter of 2024, 18 metro regions, shown in red on the map above, saw negative house price appreciation, while the remaining 366 metro areas saw positive price appreciation.

Punta Gorda, FL had the greatest decrease in house prices, while Cumberland, MD-WV had the greatest increase during the preceding four quarters.

Furthermore, property values have risen considerably since the COVID-19 outbreak.

Nationally, housing prices increased by 53% between the first quarter of 2020 and the fourth quarter of 2024.

More than half of metro regions saw house prices climb faster than the national average of 53%.

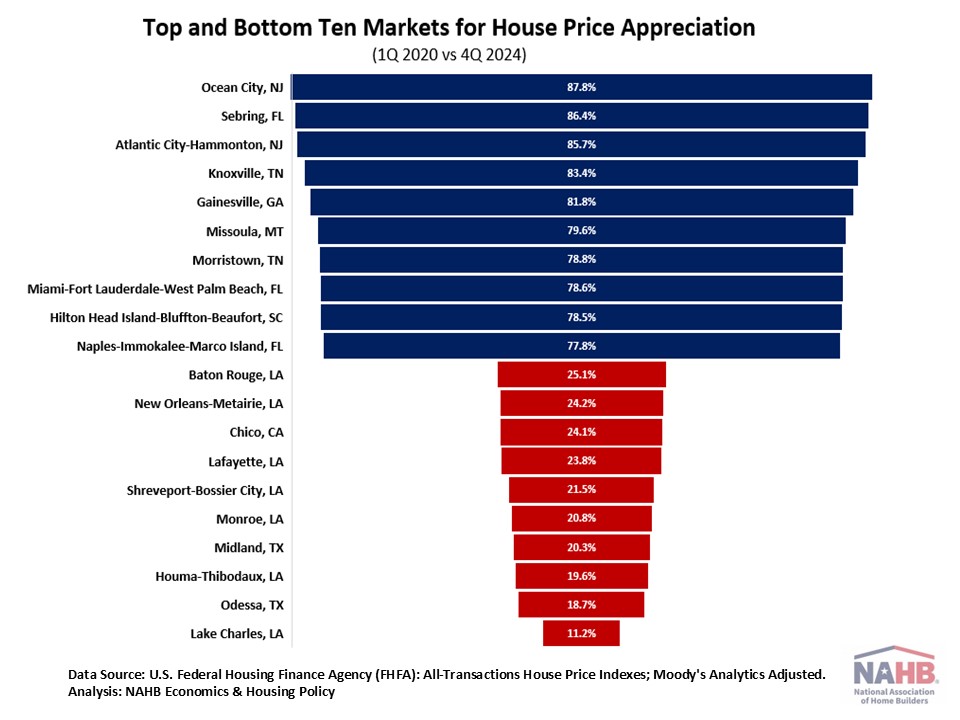

The table below lists the top and bottom ten markets for house price appreciation from the first quarter of 2020 to the fourth quarter of 2024.

House prices in all metro regions increased by 11.2% to 87.8%. The largest housing price appreciation occurred in Ocean City, New Jersey.

Lake Charles, Louisiana experienced the lowest appreciation for the third quarter in a running.

[Read more about this story on Eyeonhousing.org]