Construction Job Openings Slowdown

According to the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey (JOLTS), the number of open construction sector jobs decreased in June as home development slowed and loan rates rose.

However, this downward move is consistent with a little cooler labor market, which is a good indicator for future inflation readings and interest rate expectations.

After revisions, the whole economy’s number of open jobs fell marginally in June, from 8.23 million in May to 8.18 million.

This is also lower than the 9.13 million estimate from a year ago. According to National Association of Home Builders (NAHB) analysis, this figure must fall below 8 million on a consistent basis for the Federal Reserve to feel more confident about labor market conditions and their potential effects on inflation.

With projections nearing 8 million, rate decreases are likely in the next months if current trends continue.

While the Fed expects increased interest rates to have an influence on the economy’s demand side, the ultimate solution to the continuing national labor deficit will be to recruit, train, and retain talented workers rather than to limit worker demand.

In June, the number of open construction sector jobs fell sharply from 366,000 in May to 295,000.

Elements of the construction sector have stalled as interest rates remain high, most notably multifamily development.

This slowdown has lowered demand for construction workers, resulting in fewer job openings in the industry. The number of open jobs was 414,000 a year ago.

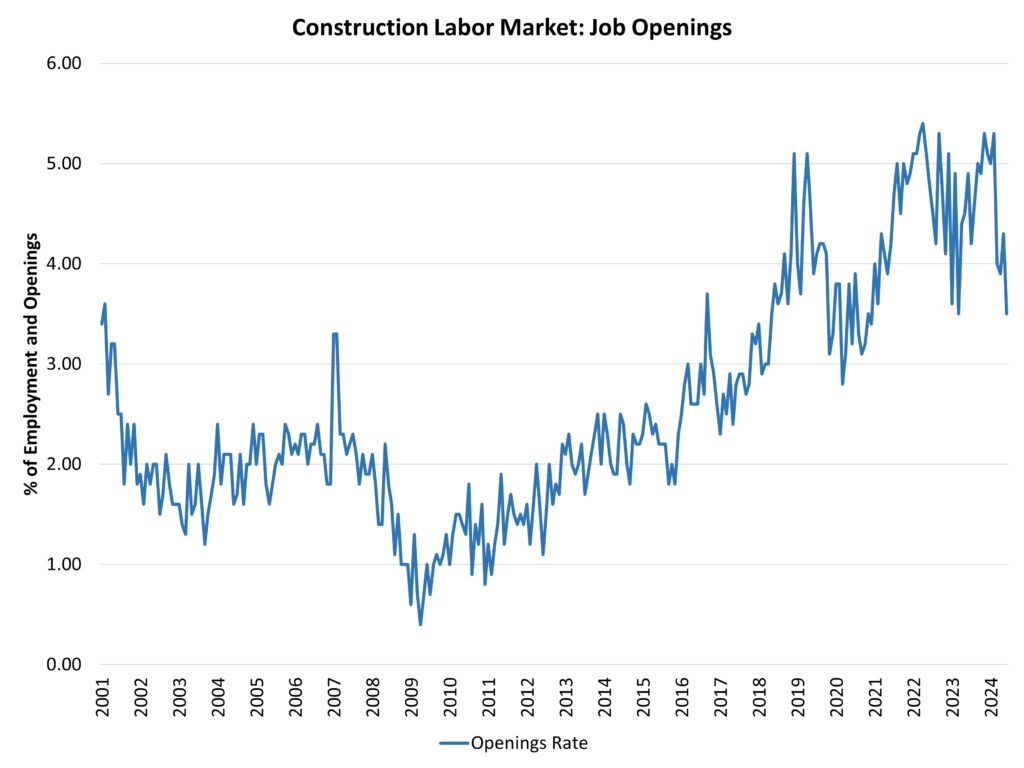

The construction job openings rate decreased to 3.5% in June, its lowest level since March 2023.

The number of single-family and multifamily residences under construction has decreased, resulting in a lower job openings rate.

This is a cyclical effect that will probably revert by 2025.

The construction layoff rate fell to 1.6% in June, from 1.8% in May.

The construction quits rate fell to 1.5% in June, down from 2.3% in May.

These results suggest that the decline in job opportunities is due to a slowing of new position targeted hiring in construction, rather than labor market churn.

[Read more about this topic on Eyeonhousing.org]