Builder Confidence Falls as Market Expects Rate Cuts

A lack of affordability, as well as buyer reluctance due to high interest rates and housing prices, contributed to a drop in builder sentiment in August.

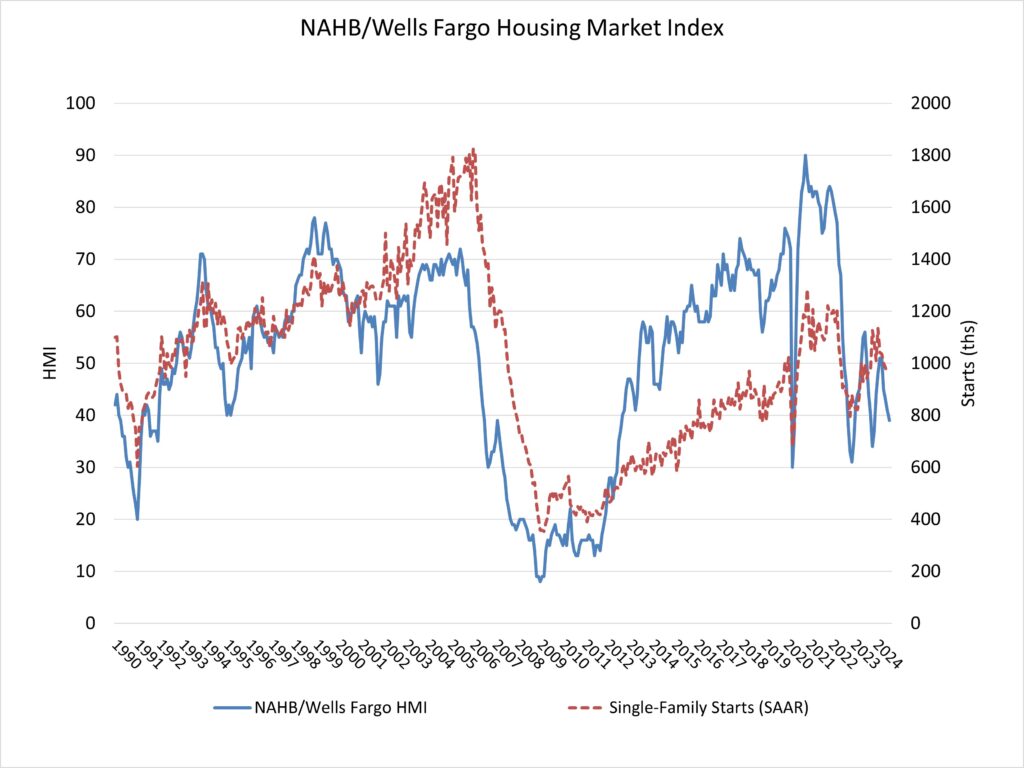

According to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI), builder confidence in the market for newly built single-family homes fell two points to 39 in August, from a downwardly revised figure of 41 in July.

This reading is the lowest since December 2023.

According to Freddie Mac, over three-quarters of all responses to the August HMI were collected during the first week of the month, when interest rates averaged 6.73%. Mortgage rates fell significantly the following week, to 6.47%, their lowest level since May 2023.

Challenging housing affordability conditions remain the top issue for prospective house buyers in the current HMI assessment, as both sales and traffic readings are sluggish.

However, with current inflation data pointing to Fed rate reduction and mortgage rates falling sharply in the second week of August, buyer demand and builder sentiment could increase in the coming months.

According to the August HMI survey, 33% of builders reduced home prices to boost sales in August, up from 31% in July and the largest level since 2024. However, the average price drop in August remained stable at 6% for the 14th consecutive month.

Meanwhile, the utilization of sales incentives rose to 64% in August from 61% in July, the highest level since April 2019.

The NAHB/Wells Fargo HMI is based on a monthly poll conducted by NAHB for over 35 years. It assesses builder perceptions of current single-family home sales and sales projections for the next six months as “good,” “fair,” or “poor.”

The study also asks builders to rank traffic from prospective purchasers as “high to very high,” “average,” or “low to very low.”

Scores for each component are then used to produce a seasonally adjusted index, with any figure more than 50 indicating that more builders regard conditions as favorable rather than poor.

In August, the HMI indicator measuring current sales conditions slipped two points to 44, as did the gauge measuring prospective buyer traffic, which dipped two points to 25.

The component measuring sales forecasts over the next six months rose one point to 49.

Looking at the three-month moving averages for regional HMI scores, the Northeast slipped four points to 52, the Midwest dropped four points to 39, the South dipped two points to 42, and the West remained steady at 37. The HMI tables can be accessed at nahb.org/hmi.

[Read more about this topic on Eyeonhousing.org]