Build-for-rent single-family home construction fall back

Single-family built-for-rent construction fell year on year in the fourth quarter of 2024, as rising finance costs limited building activity.

This slowdown is comparable to the slowing of multifamily construction in recent quarters.

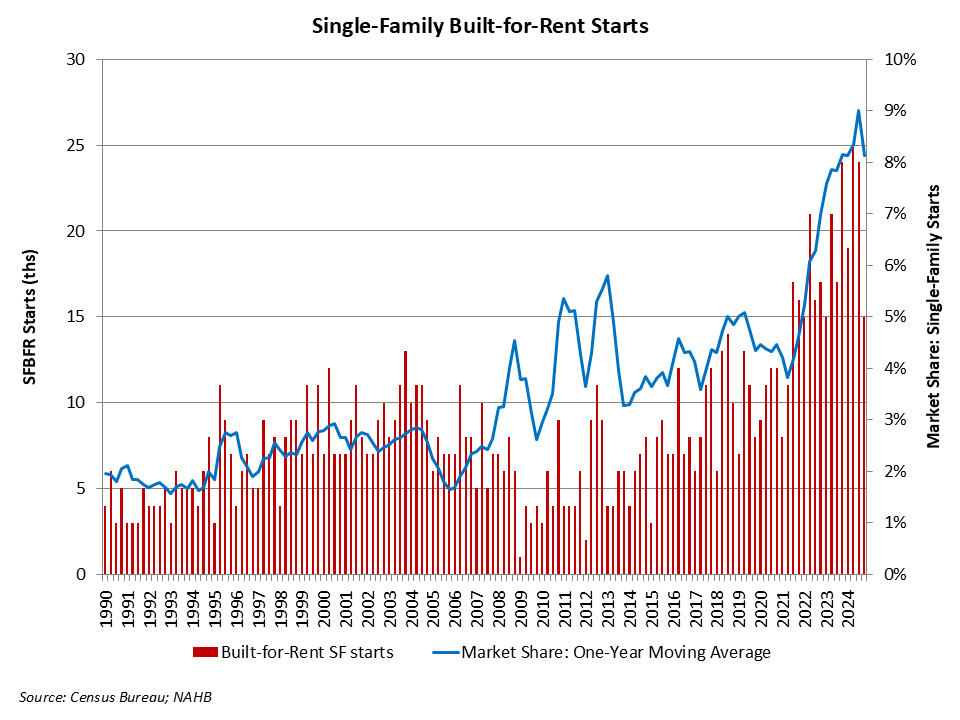

According to NAHB’s analysis of data from the Census Bureau’s Quarterly Starts and Completions by Purpose and Design, about 15,000 single-family built-for-rent (SFBFR) starts occurred in the fourth quarter of 2024. This is 38% less than the fourth quarter of 2023.

Over the latest four quarters (2024 as a whole), 83,000 such homes were built, representing an 8% increase over the 77,000 anticipated SFBFR starts in the four quarters preceding that period (2023 overall).

The SFBFR market provides inventory amid concerns about home affordability and downpayment requirements in the for-sale market, particularly at a time when an increasing number of consumers seek more room and a single-family structure.

Single-family built-for-rent construction has structural differences from other newly built single-family homes, particularly in terms of home size. Investor demand for single-family homes, both new and existing, has slowed as interest rates have risen.

Quarter-to-quarter changes in this market segment are often not statistically significant due to its tiny size. The current four-quarter moving average of market share (8%) is larger than the historical average of 2.7% (1992-2012).

Importantly, in this analysis, the estimates include only properties created and retained by the builder for rental reasons.

According to industry surveys, properties sold to another party for rental purposes may account for an additional three to five percent of single-family starts.

According to Census data, the percentage of single-family homes built as condos (non-fee simple) has increased, averaging more than 4% in recent quarters.

Some, if not all, of these residences will be rented out. Furthermore, because these units are sometimes erected on a single plot of land, it is possible that some single-family built-for-rent units are being counted as “horizontal multifamily” starts.

However, NAHB conducted spot checks with permitting offices and found no indication of this data error.

With the advent of the Great Recession and declining homeownership rates, the share of built-for-rent homes grew in the years after the recession. SFBFR homes have a tiny market share, but they have obviously expanded.

Given the affordability issues in the for-sale market, the SFBFR sector is projected to keep a significant market share.

However, SFBFR building is expected to decelerate in the short term as the return on new transactions improves.

[Read more about this story on Eyeonhousing.org]