Absorption Rates Dive as Multifamily Completions Hit Record Highs

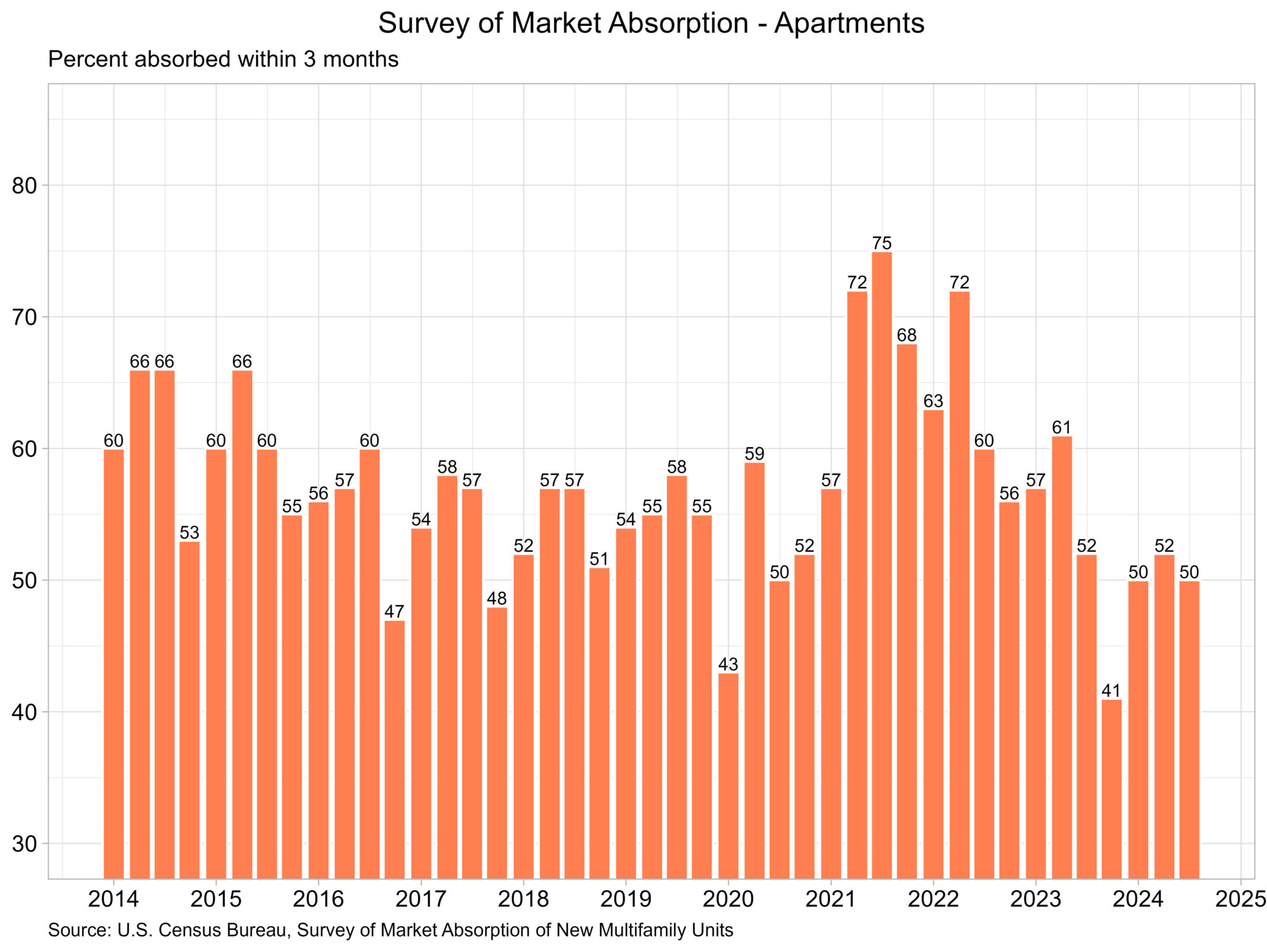

According to the Census Bureau’s most recent Survey of Market Absorption of New Multifamily Units (SOMA), the percentage of new apartment units absorbed within three months after completion has continued to decline.

The survey focuses on new apartments in multifamily residential structures with five or more units.

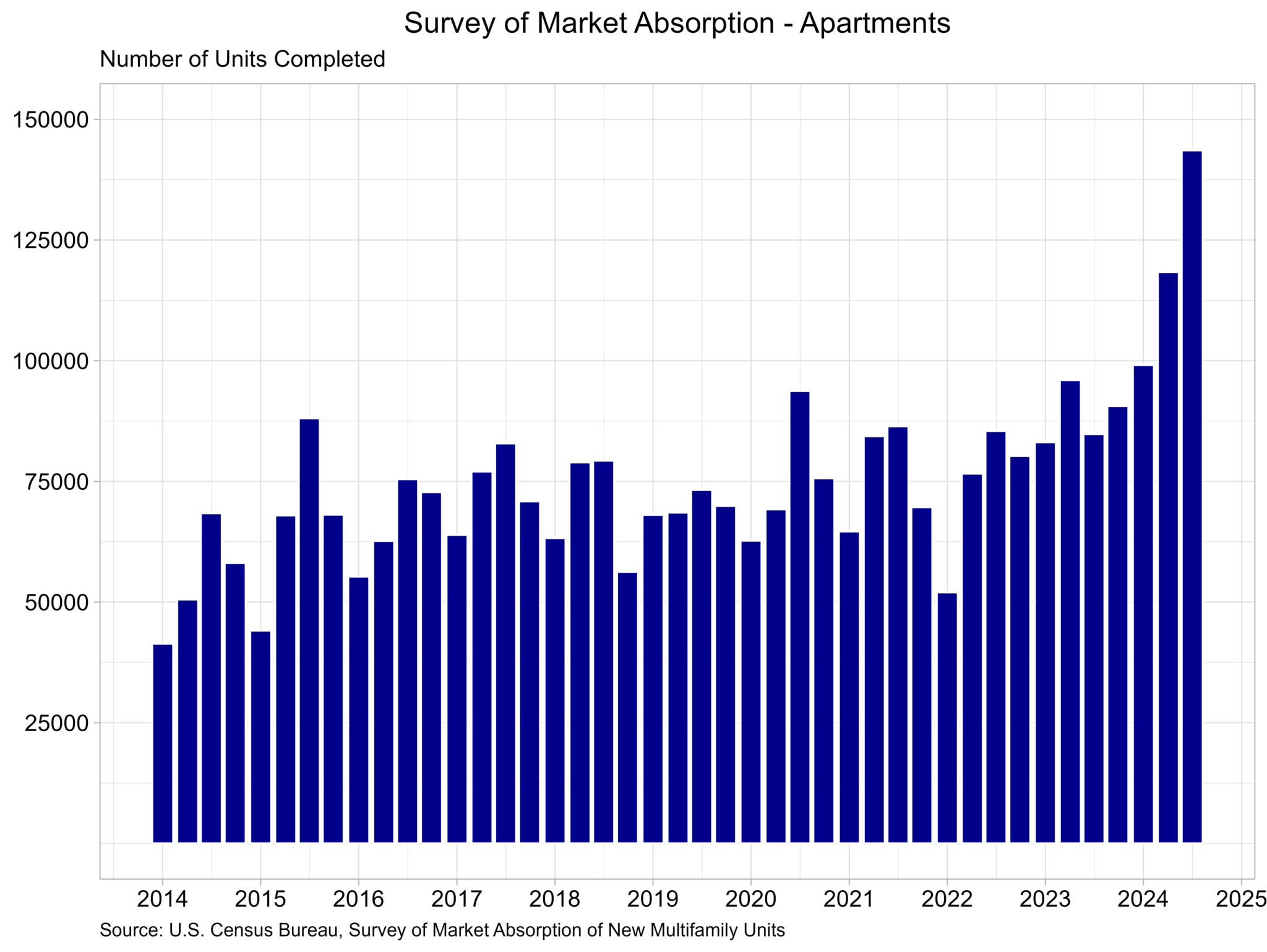

The number of new multifamily units finished reached a new high in the third quarter of 2024, marking the third consecutive quarter with a record number of completions.

Apartments

The percentage of flats absorbed within three months has dropped dramatically from a high of 75% in the third quarter of 2021, as seen in the graph above.

Currently, the rate is at 50%, which is accompanied by an increase in completions, with SOMA forecasts showing a new high of 143,600 units in the third quarter of 2024. This is about 70% higher than the previous year’s total of 84,830 completions.

The number of multifamily units completed has only increased since 2023, when the number of units under construction peaked at more than one million.

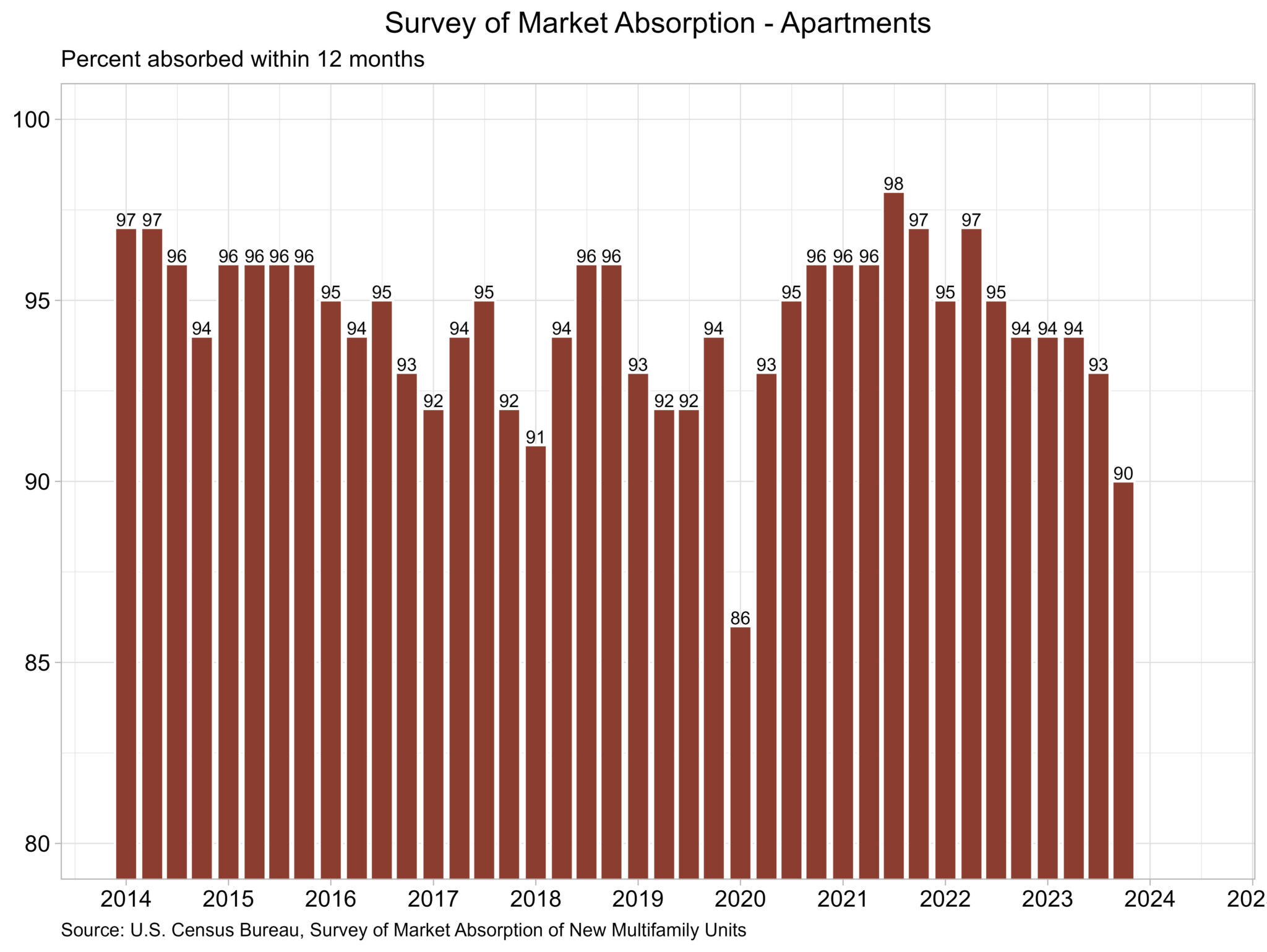

In addition to the three-month absorption rate and completions, SOMA reports absorption rates within six, nine, and twelve months following completion. Focusing just on the 12-month absorption rate, it fell to its lowest level since the beginning of the epidemic, at 90%.

This means that 10% of the 90,630 flats finished in the fourth quarter of 2023 are empty. As completions climbed during the past year, so did the quantity of available flats.

Furthermore, regional SOMA data suggests that the Northeast may be responsible for a lower 12-month absorption rate, with roughly 23% of fourth-quarter completions in 2023 remaining unoccupied.

This is far higher than any other region, with the Midwest at 7%, the South at 9%, and the West at 5%.

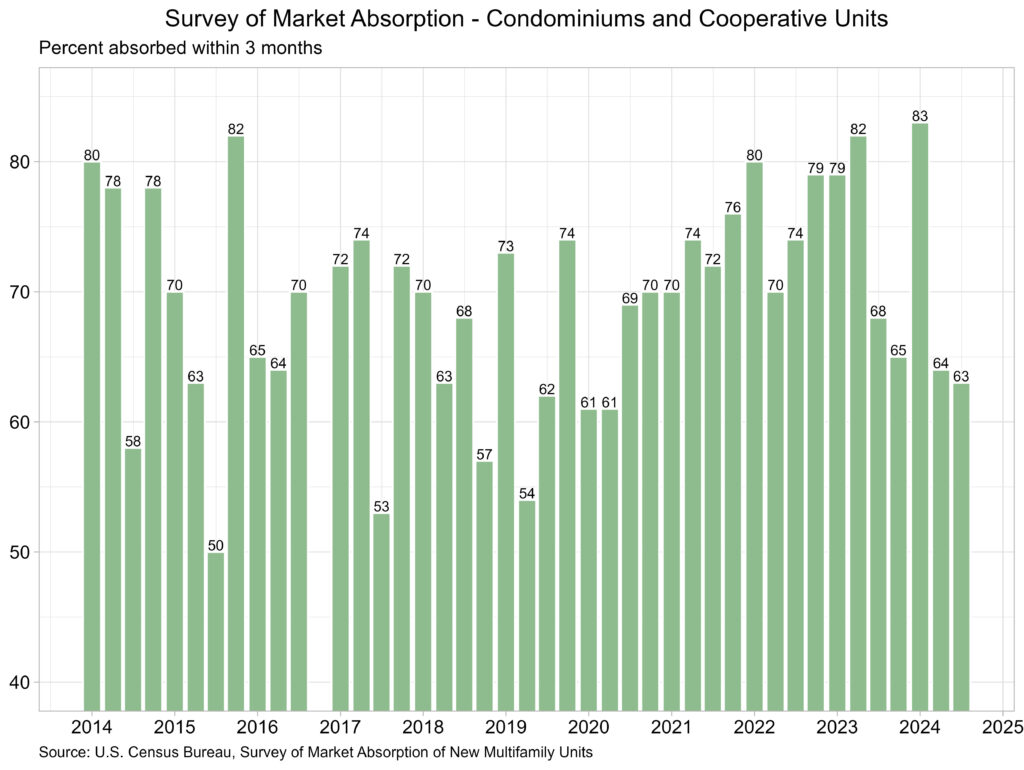

Condominiums and cooperative Units

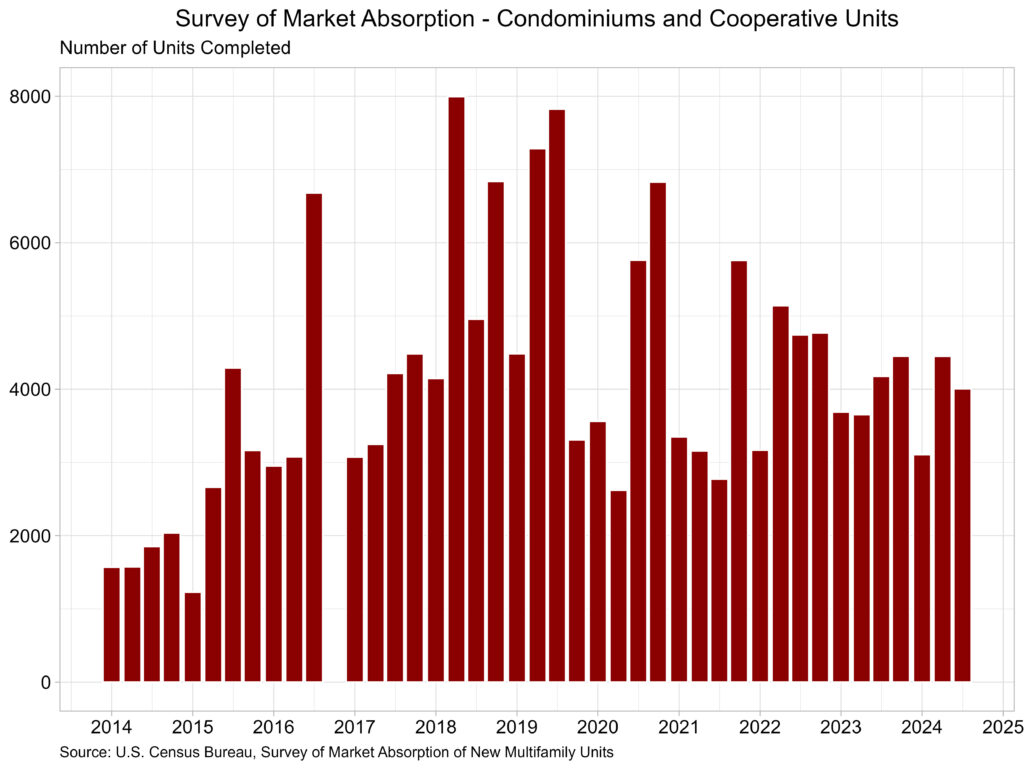

The absorption rate for new condominiums and cooperative units fell to 63% in the quarter, a 1 percentage point decrease from the previous quarter.

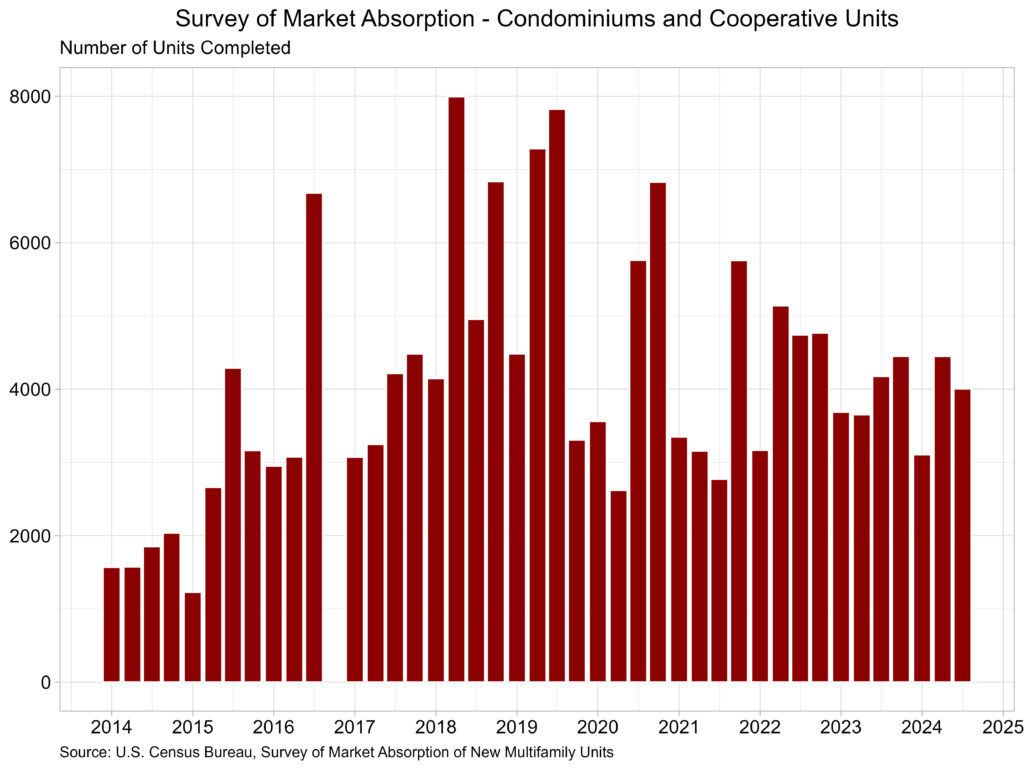

According to the SOMA, total completions of new condominiums and cooperative units decreased from 4,452 to 4,008 during the quarter.

Quarterly completions of these units peaked in the second quarter of 2018, at 7,996, but have progressively declined since then.

[Read more on this story at Eyeonhousing.org]