2024 Residential Construction Input Price Growth Slows

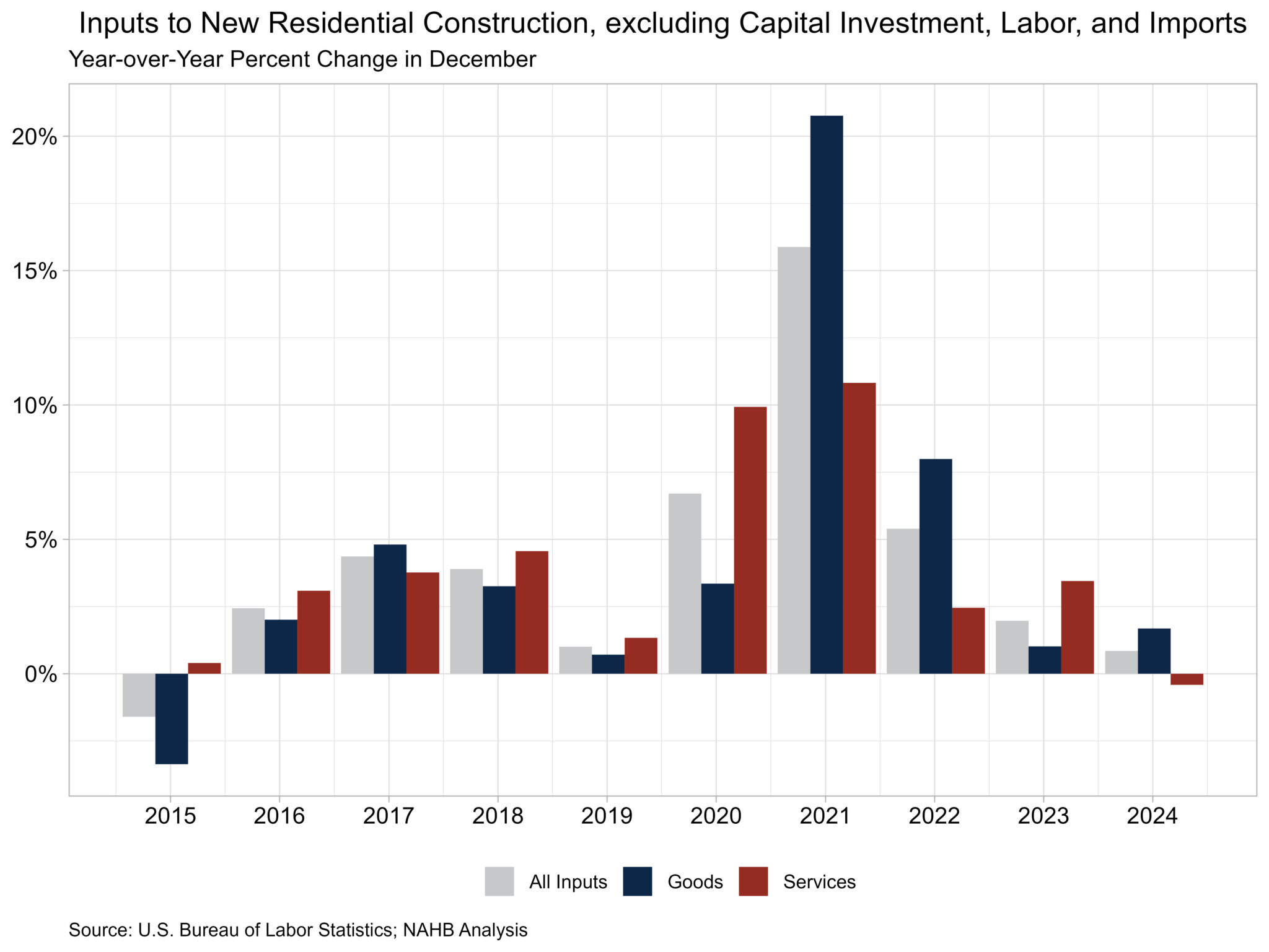

According to the most current Producer Price Index (PPI) report published by the United States Bureau of Labor Statistics, prices for new residential building inputs—excluding capital investment, labor, and imports—remained steady in December.

This index increased by 0.8% in 2024, the lowest yearly rise since its establishment in 2014.

The inputs of the new residential building price index can be divided into two categories: commodities and services.

The goods component climbed 1.7% year on year, while services declined by 0.4%.

For contrast, the total final demand index climbed 3.3% in 2024, with final demand for commodities increasing 1.8% and final demand for services increasing 4.0% year on year.

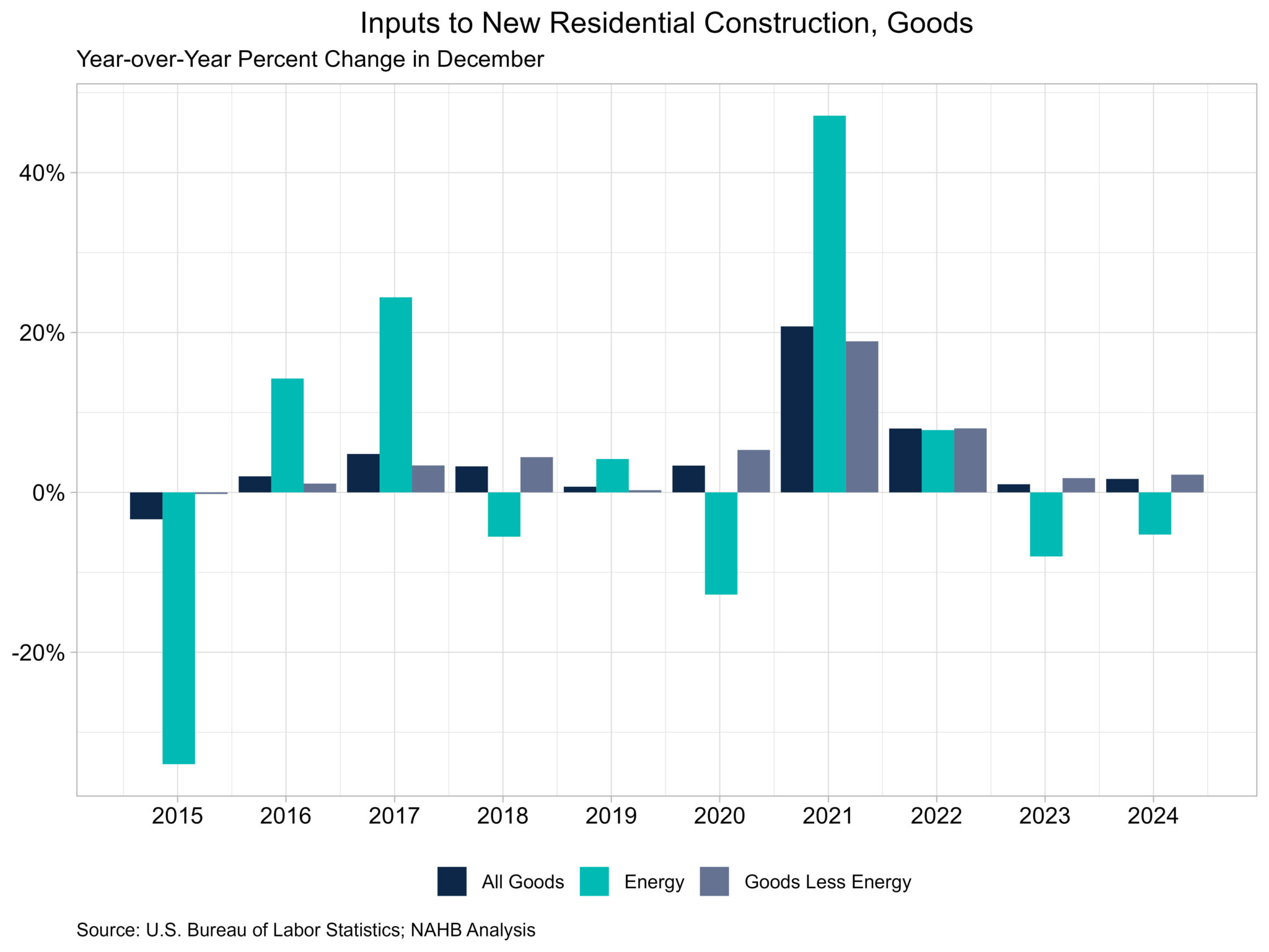

Input Goods

The goods component accounts for roughly 60% of the total residential building inputs price index. In December, the price of input products for new residential building fell 0.1% compared with November.

The input goods to residential building index can be further divided into two components, one assessing energy inputs and the other measuring items that do not require energy input.

The latter of these two components essentially indicates building materials utilized in residential construction, which account for around 93% of the goods index.

In 2024, the price of commodities used in residential building increased by 1.7%, significantly more than the 1.0% increase in 2023. This increase can be attributable to rising building material prices, which increased by 2.2% in 2024.

The cost of energy inputs declined for the second consecutive year, falling 5.3% in 2024.

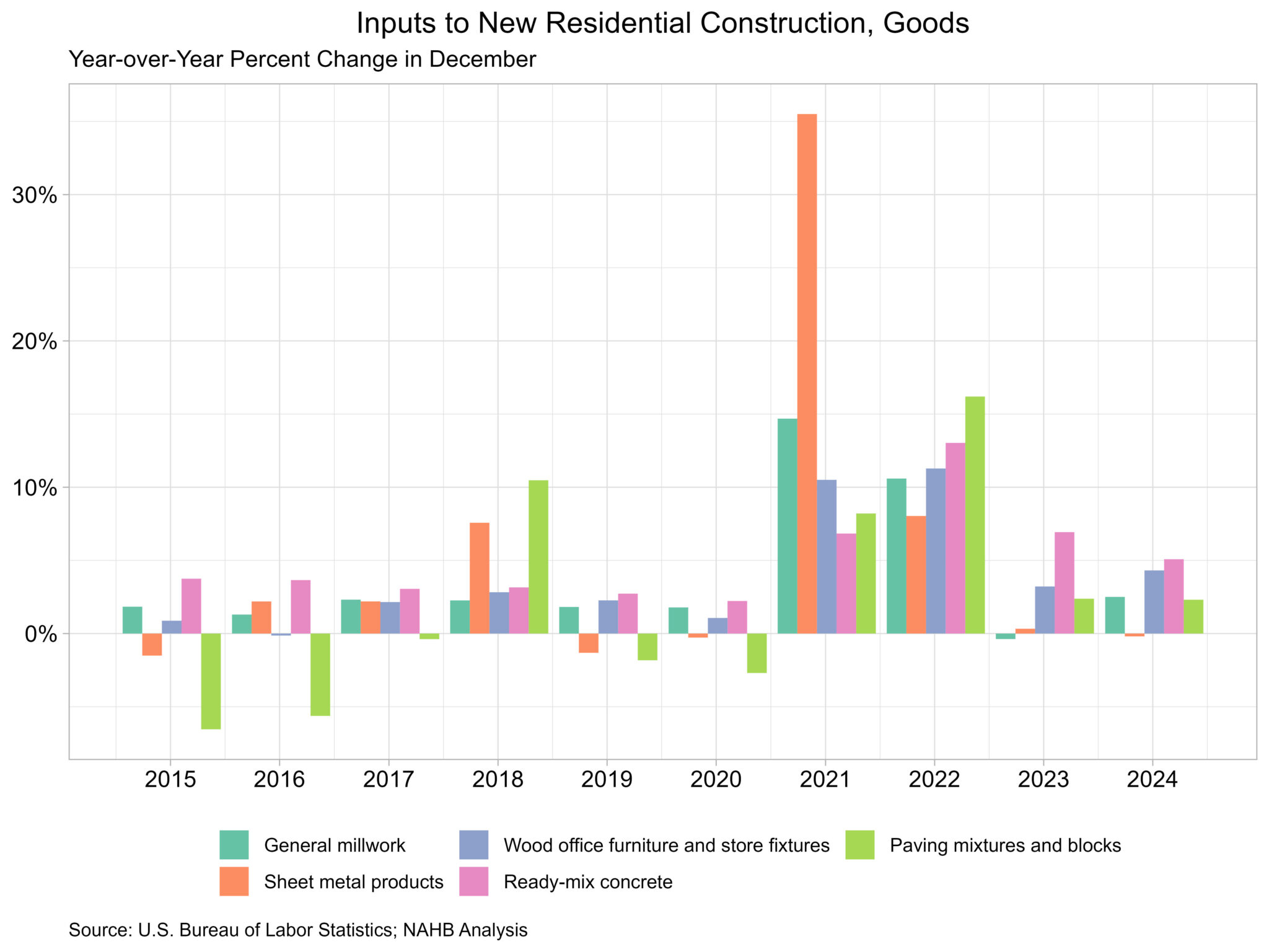

At the individual commodity level, the five building materials with the most importance to the new residential construction index were ready-mix concrete, general millwork, paving mixtures/blocks, sheet metal products, and wood office furniture/store fixtures.

Except for sheet metal products, the majority of these commodities experienced price growth in 2024.

Ready-mix concrete increased by 5.1%, wood office furniture/store fixtures by 4.3%, general millwork by 2.5%, and paving mixtures/blocks by 2.3%, while sheet metal products decreased by 0.2%.

Softwood lumber, not edge worked, was the product used in new residential construction with the biggest price gain in 2024, increasing 14.7%.

The product with the greatest price reduction was No. 2 diesel fuel, which fell 13.9%.

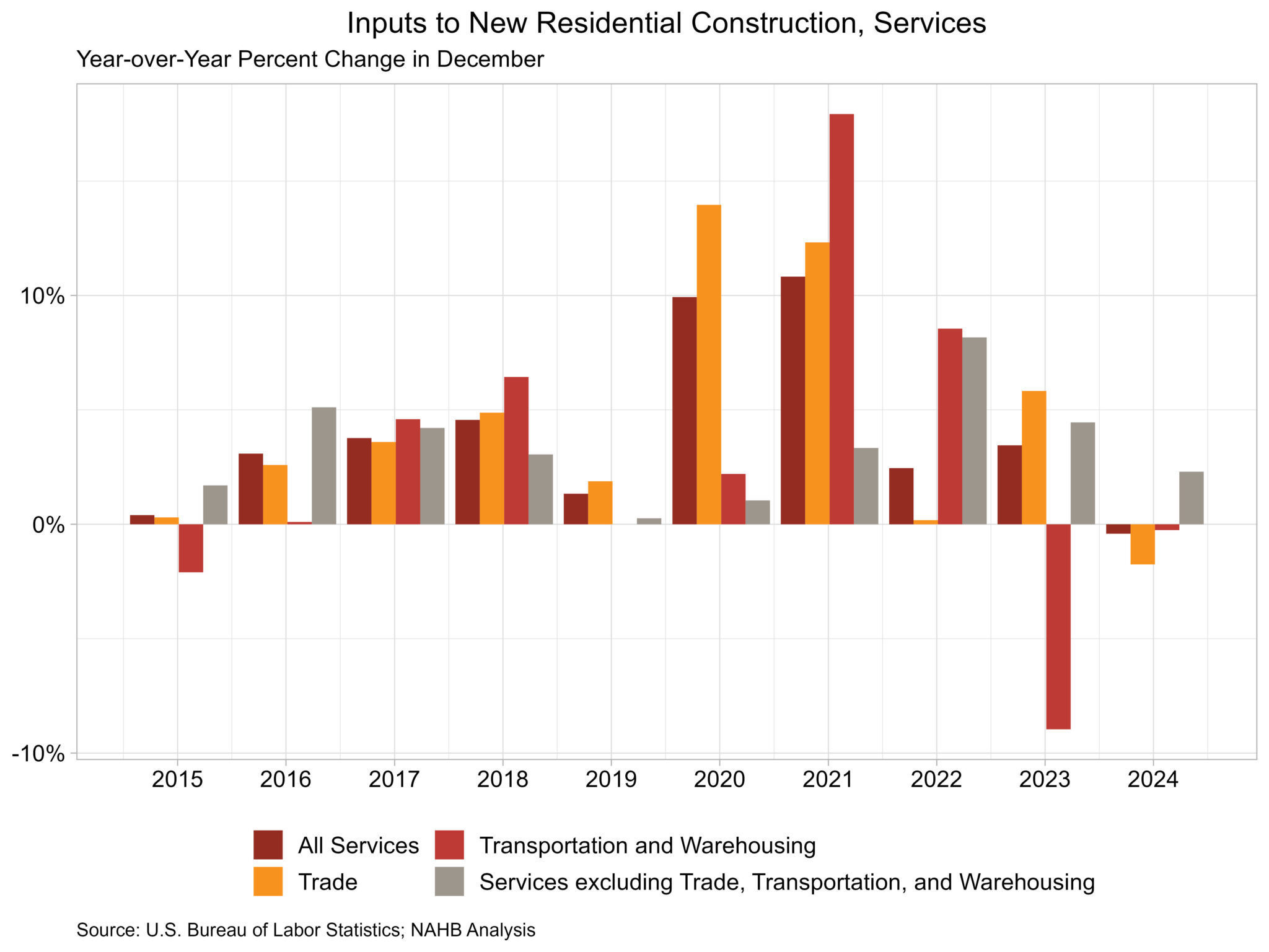

Input services

Input prices for residential building services increased by 0.5% in December compared to November.

The price index for service inputs to residential construction is divided into three sections: trade services, transportation and warehousing services, and services excluding trade, transportation, and warehousing.

The largest component is trade services (about 60%), followed by services other than trade, transportation, and warehousing (approximately 29%), and finally transportation and warehousing services (around 11%).

The largest component, commerce services, fell 1.8% in 2024 after rising 5.8% in 2023.

Credit deposit services advanced the most in 2024, gaining 21.2% year on year, while prices for metal, mineral, and ore wholesaling services declined the most, by 19.2%.

[Read more about this story on eyeonhousing.org]