Builder Confidence Rises Despite Market Risk Concerns

Builder sentiment rose to start the year on anticipation of improving economic growth and regulatory environment.

At the same time, builders expressed anxiety about rising building material tariffs and expenses, as well as a greater government deficit, which would raise inflation and mortgage interest rates.

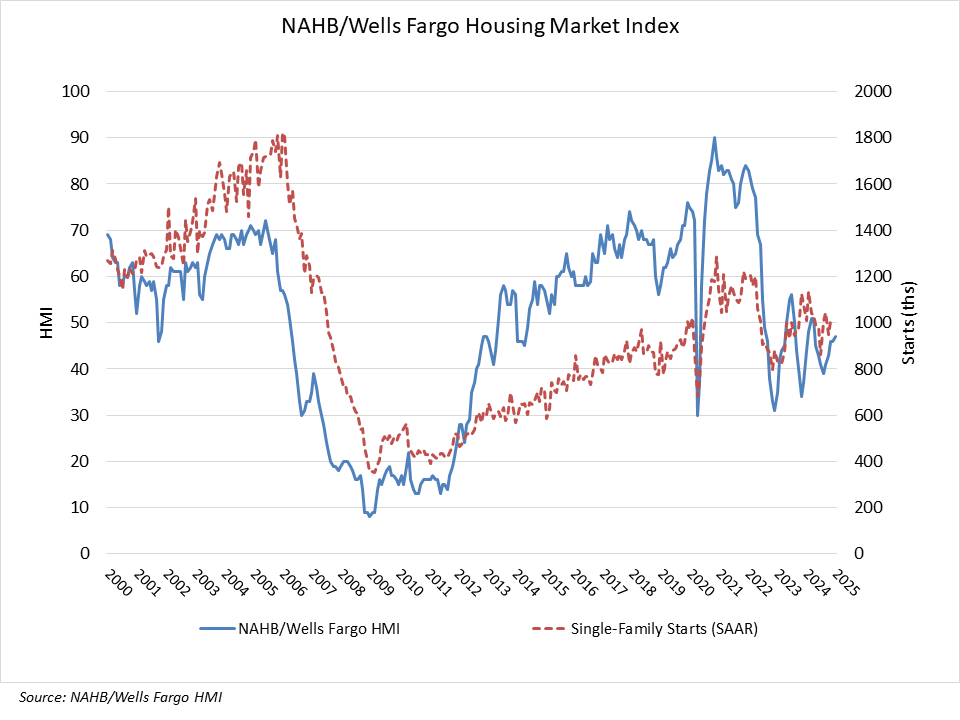

The National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) reported that builder confidence in the market for newly built single-family homes was 47 in January, up one point from December.

Builders face significant difficulty in meeting housing demand in the near term, with mortgage rates rising from around 6.1% in late September to more than 6.9% today.

Land is expensive, and finance for private builders remains pricey. However, there is hope that legislators would take the impact of regulatory obstacles seriously and make adjustments by 2025.

NAHB predicts a small increase in single-family dwelling starts in 2025, as the market faces offsetting positive and negative risks from an improving regulatory environment and persistently high interest rates.

While the Federal Reserve’s continuous, albeit gradual, easing might improve financing for private builders who are currently priced out of some local markets, builders indicate that cancellations are increasing as mortgage rates return to around 7%.

The most recent HMI survey also indicated that 30% of builders reduced home prices in January. Since last July, this percentage has remained constant at 30% to 33%.

Meanwhile, the average price drop in January was 5%, the same as in December. In January, sales incentives were used 61% of the time. Since last June, this proportion has maintained between 60% and 64%.

The NAHB/Wells Fargo HMI is based on a monthly poll conducted by NAHB for over 35 years.

It assesses builder perceptions of current single-family home sales and sales projections for the next six months as “good,” “fair,” or “poor.” The study also asks builders to rank traffic from prospective purchasers as “high to very high,” “average,” or “low to very low.” Scores for each component are then used to produce a seasonally adjusted index, with any figure more than 50 indicating that more builders regard conditions as favorable rather than poor.

The HMI indicator assessing current sales conditions grew three points to 51, while the gauge charting prospective buyer traffic increased two points to 33.

The component measuring sales forecasts in the next six months declined six points to 60 as interest rates rose.

While this is a cautious note, the future sales component remains the largest of the three sub-indices, much exceeding the breakeven level of 50.

Looking at three-month moving averages for regional HMI scores, the Northeast rose five points to 60, the Midwest rose one point to 47, the South rose one point to 46, and the West decreased one point to 40.

The HMI tables can be accessed at nahb.org/hmi.

[Read more about this story on eyeonhousing.org]