Higher Rates Lower October New Home Sales

In October, many potential home buyers stayed away due to steadily rising mortgage rates and continued affordability issues.

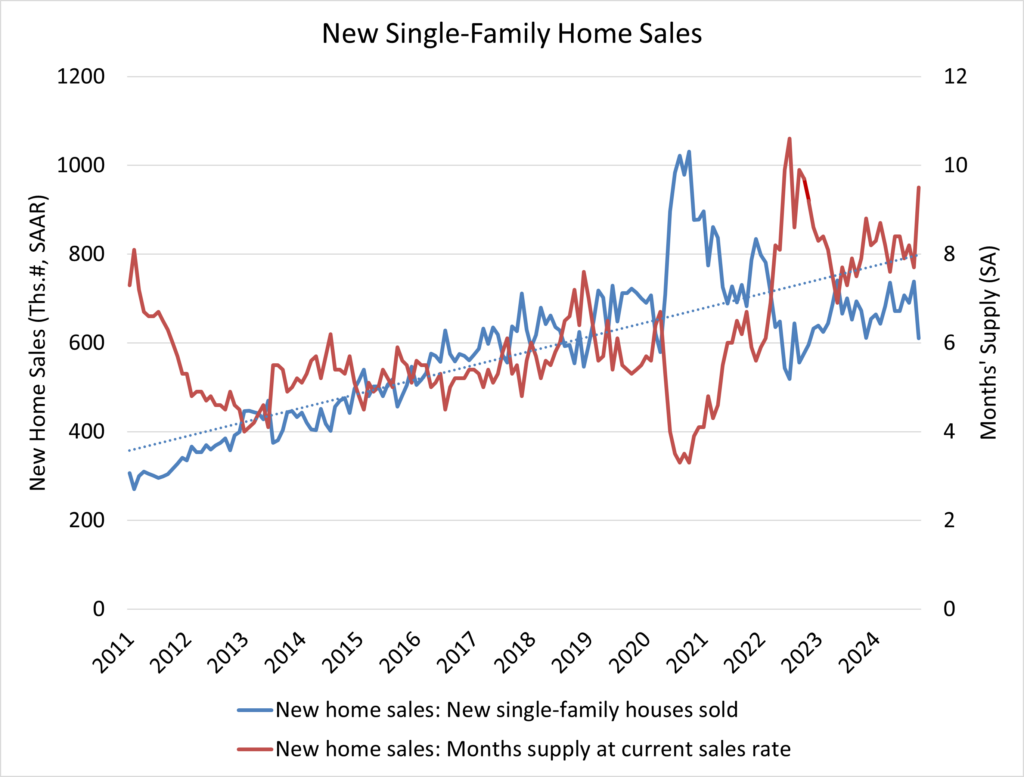

Sales of newly built single-family houses fell 17.3% in October to a seasonally adjusted annual rate of 610,000, according to freshly released statistics from the U.S. Department of Housing and Urban Development and the Census Bureau.

The pace of new house sales in October fell 9.4% from a year ago. October new home sales are up 2.1% year to date.

A new home sale takes place when a sales contract is signed or a deposit is accepted.

The home can be at any stage of development: unfinished, under construction, or completed.

In addition to compensating for seasonal factors, the October reading of 610,000 units represents the number of homes that would sell if the current pace maintained for the following 12 months.

New single-family home inventories remained elevated in October, at 481,000, up 8.8% from the previous year. This equates to 9.5 months’ supply at the current sales rate. A measure close to six months’ supply is deemed balanced.

While a 9.5-month supply could be deemed excessive in normal market conditions, there is now just 4.2 months’ supply of existing single-family houses on the market.

Combined, new and current total months’ supply remains below historic averages at around 4.9 months, however this figure is projected to rise as more house sellers test the market in the coming months.

A year ago, there were 76,000 completed, ready-to-occupy homes for sale (not seasonally adjusted). By the end of October 2024, that figure had risen 52.6% to 116,000.

However, completed, ready-to-occupy inventory still accounts for only 24% of total inventory, with homes under construction accounting for 55%.

The remaining 22% of new homes sold in October were not under construction when the sales contract was signed.

The typical new home sale price in October increased 2.5% to $437,300, up 4.7% from a year ago. In terms of affordability, the percentage of entry-level homes priced under $300,000 has progressively decreased in recent years. Only 13% of the properties were priced in the entry-level affordable bracket, with 37% priced above $500,000.

Most of the properties were priced between $300,000 and $500,000.

Year over year, new house sales are up 35.3% in the Northeast and 15.9% in the Midwest. New house sales have fallen 19.7% in the South and 1.3% in the West.

[Read more about this topic on Eyeonhousing.org]