Second-Home Areas Growing in Homebuilding Market

According to NAHB’s featured topic for the second quarter HBGI, second homes account for 17.5% of single-family and 8.6% of multifamily construction.

The recent NAHB survey reveals that there are 6.5 million second houses in the United States, accounting for 4.6% of total housing stock.

For the purposes of this analysis, a second house area is defined as a county with a second home share more than 10.3% of its total housing stock. According to this criterion, 788 counties qualify as second home areas.

Single-family

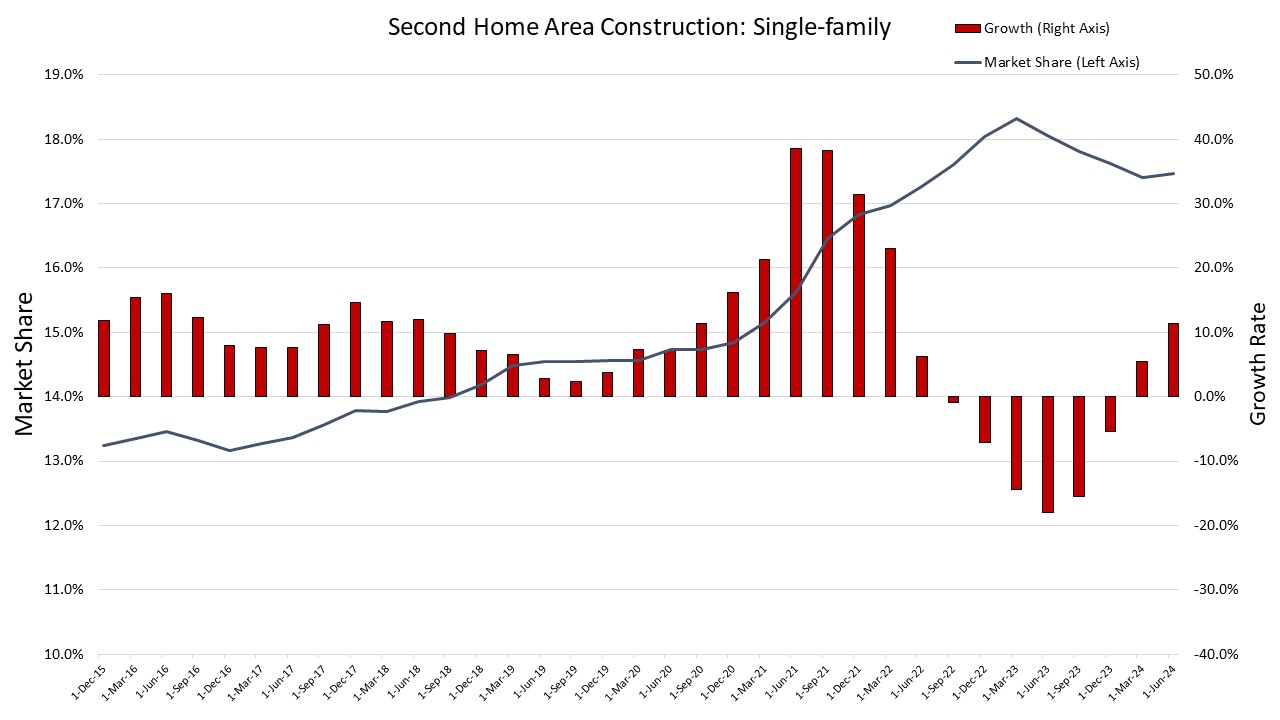

According to single-family permit statistics, the market share for development in second home locations has increased by more than four percentage points over the last nine years.

Second home regions had a market share of 13.2% in the fourth quarter of 2015.

This geography’s market share rose to 17.5% in the second quarter of 2024.

However, this reading is lower than the peak of 18.3% in the first quarter of 2023.

In the third quarter of 2021, the top growth rate in construction for second homes areas reached 38.5%.

The first recorded drop in growth rate happened in the third quarter of 2022.

This decrease in growth rate was followed by five quarters of falls until the first quarter of 2024.

Between the fourth quarter of 2015 and the second quarter of 2024, second home areas averaged a 9.1% growth rate, while non-second home areas had a 5.1% growth rate in single-family housing.

Multifamily

Although smaller, the market share for second homes has increased in multifamily building.

The market share was 5.5% in the fourth quarter of 2015, and it is now 8.6%, up 3.1 percentage points.

This increase in market share has been more unpredictable than that of single-family housing, as multifamily building growth in second-home locations has not been stable.

There have been three times where multifamily development growth has declined in these areas, including 2017 and early 2021.

The third period of decline is currently underway, with two consecutive quarters of negative growth to begin 2024.

The latest growth rate is a drop of 11.8%. This is down from a high of 53.1% in the third quarter of 2022, as multifamily building has slowed nationwide.

[Read more about this topic on Eyeonhousing.org]