Builder Confidence Drops to Lowest Level in 7 Months as Rates Bite

Mortgage rates averaged 6.92% in June, according to Freddie Mac, and high rates for construction and development loans continue to dampen builder optimism.

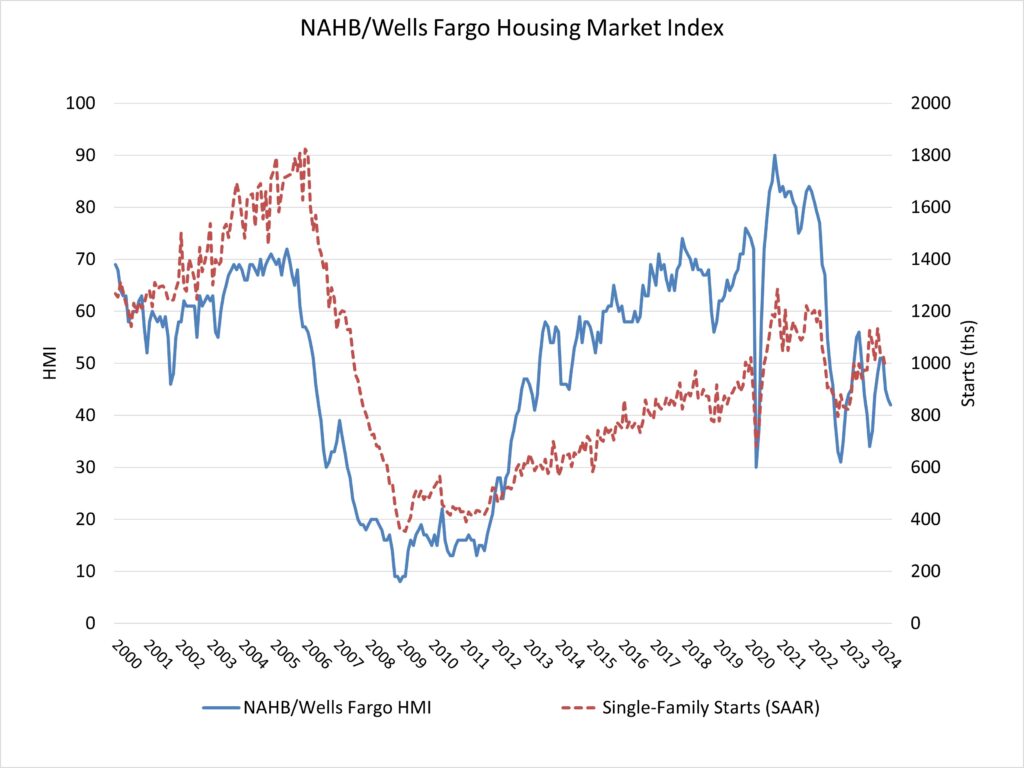

Builder confidence in the market for newly built single-family homes was 42 in July, down one point from June, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI).

This marks the lowest reading since December 2023.

While purchasers appear to be waiting for lower interest rates, builders’ six-month sales expectations have increased, indicating that builders expect mortgage rates to fall later this year as inflation figures show signs of easing.

Despite maintaining above the Federal Reserve’s 2% target, inflation looks to be returning to a cooling trend after rising in the first quarter.

NAHB expects Fed rate cuts to begin at the end of this year, lowering lending rates for house purchasers, builders, and developers.

And, while housing inventory is rising, total market inventory remains low at 4.4 months’ supply, indicating a long-term need for increased home building.

According to the July HMI survey, 31% of builders reduced home prices to boost sales in July, up from 29% in June.

However, the average price drop in July remained at 6% for the 13th consecutive month.

Meanwhile, the utilization of sales incentives remained stable at 61% in July, matching the number from June.

The NAHB/Wells Fargo HMI is based on a monthly poll conducted by NAHB for over 35 years.

It assesses builder perceptions of current single-family home sales and sales projections for the next six months as “good,” “fair,” or “poor.”

The study also asks builders to rank traffic from prospective purchasers as “high to very high,” “average,” or “low to very low.”

Scores for each component are then used to produce a seasonally adjusted index, with any figure more than 50 indicating that more builders regard conditions as favorable rather than poor.

The HMI index tracking current sales conditions in July dipped one point to 47, while the gauge tracking prospective buyer traffic fell one point to 27.

The component measuring sales forecasts over the next six months rose one point to 48.

Looking at the three-month moving averages for regional HMI scores, the Northeast declined six points to 56, the Midwest four points to 43, the South two points to 44, and the West four points to 37.

[Read more about this topic on Eyeonhousing.org]